An essential feature of Aspire is its flexibility in time tracking. Users can manually input time entries when the mobile app is unavailable, ensuring seamless recording of work hours even in offline scenarios. This capability enhances the adaptability of Aspire, allowing users to maintain accurate time records regardless of connectivity challenges.

This user-friendly functionality empowers individuals to efficiently manage and document their time, contributing to the overall convenience and reliability of the Aspire platform.

Why Use Aspire’s Manual Time Entry?

Manual Time Entry in Aspire offers the following benefits:

1. Enter Time:

Aspire provides users with the convenience of manually entering time entries, ensuring flexibility and accuracy in recording work hours, particularly when the mobile app is unavailable, thus adapting to various work scenarios seamlessly.

2. Correct Mistakes During Mobile Time Tracking:

The user-friendly interface of Aspire empowers individuals to promptly rectify errors in real-time during mobile time tracking, preventing inaccuracies and enhancing the precision of recorded work hours.

3. Adjust Time on Direct and Indirect Work Tickets:

Aspire enables users to effortlessly adjust time entries on direct or indirect work tickets, offering a streamlined process for refining and fine-tuning recorded hours, enhancing precision and accountability in project and task management. It also ensures your employees are receiving the right amount of pay and the customers are billed accurately.

Summary of the Process for Manual Time Entry

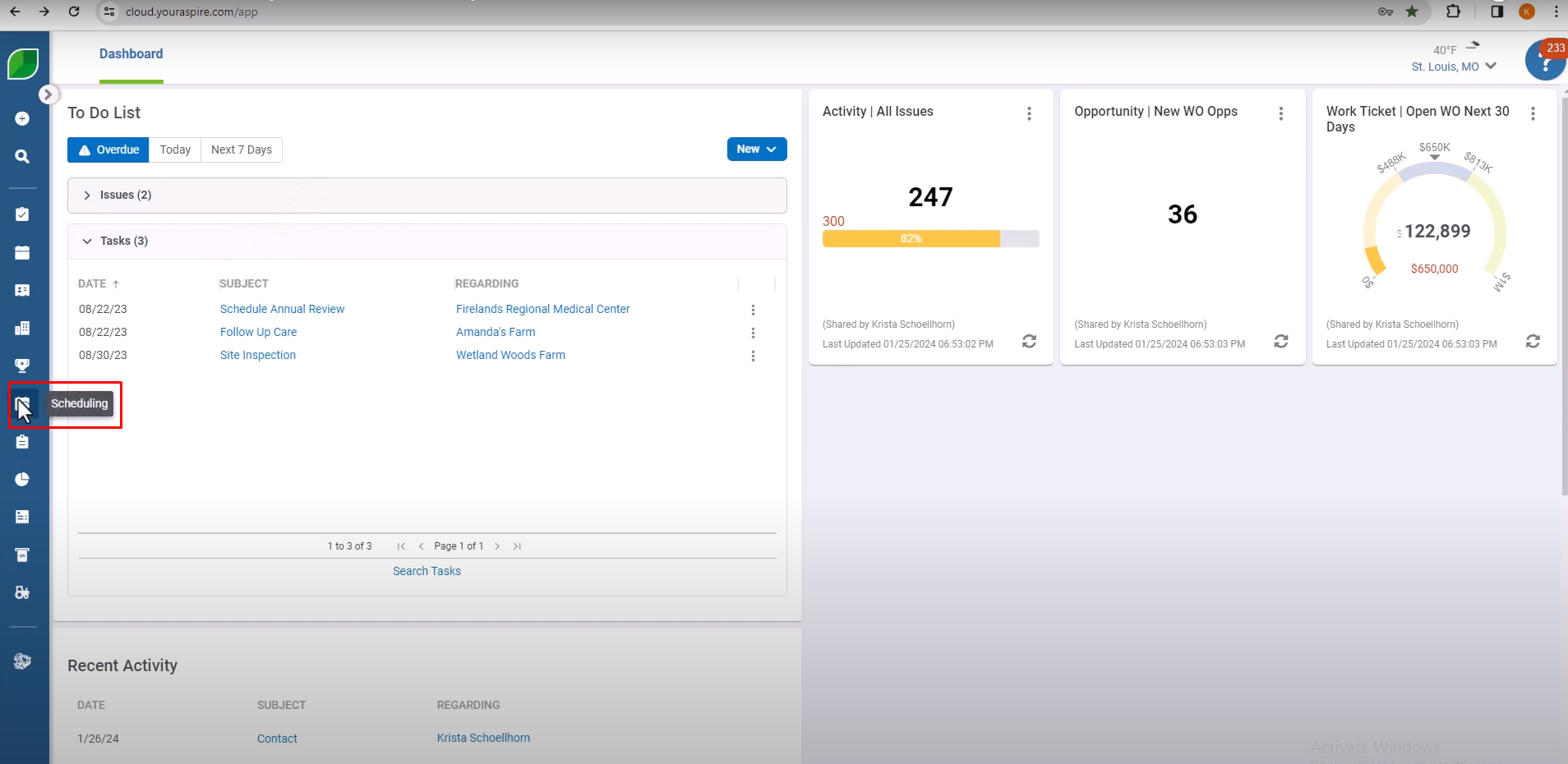

1. Go to the schedule board by clicking on the schedule icon in the blue side menu.

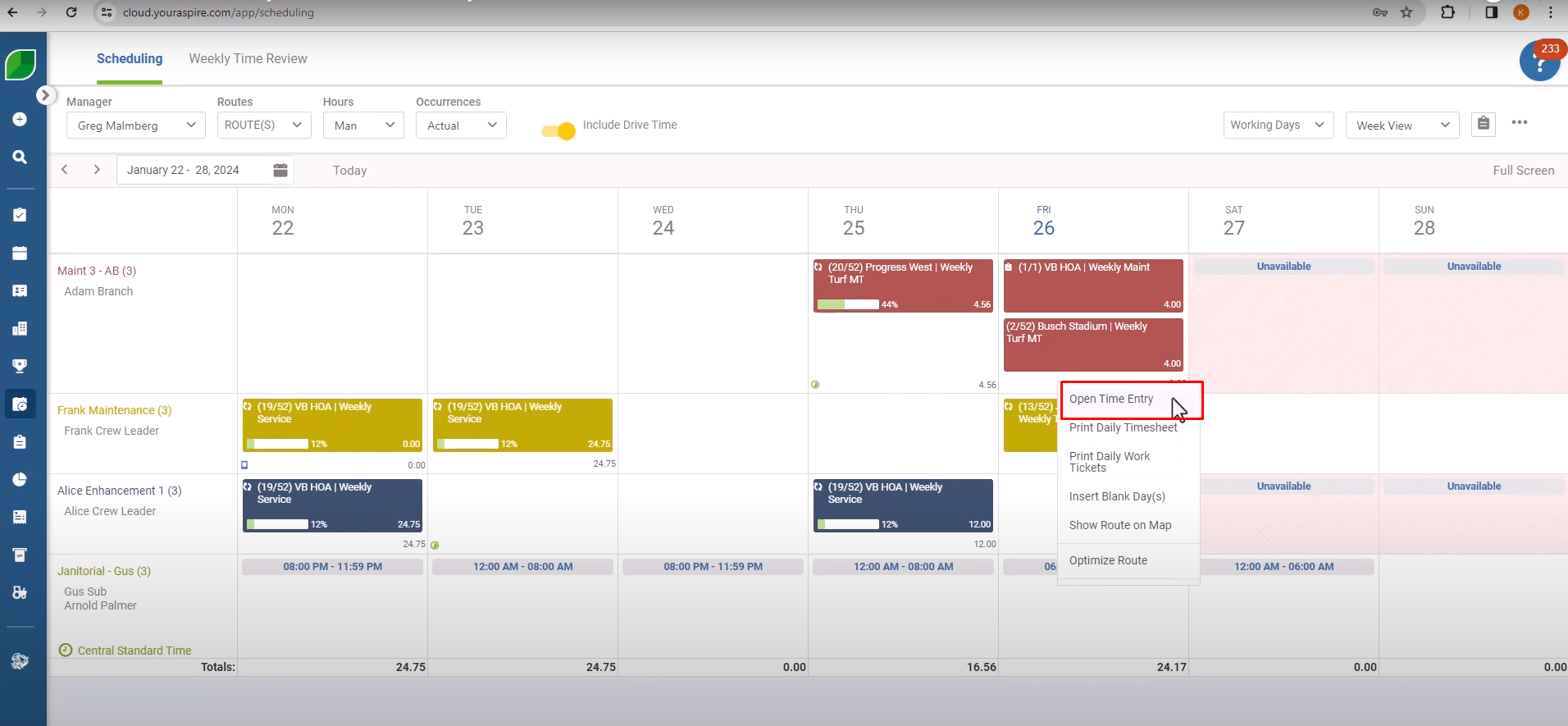

2. Find the date, right-click, and select “Open Time Entry.”

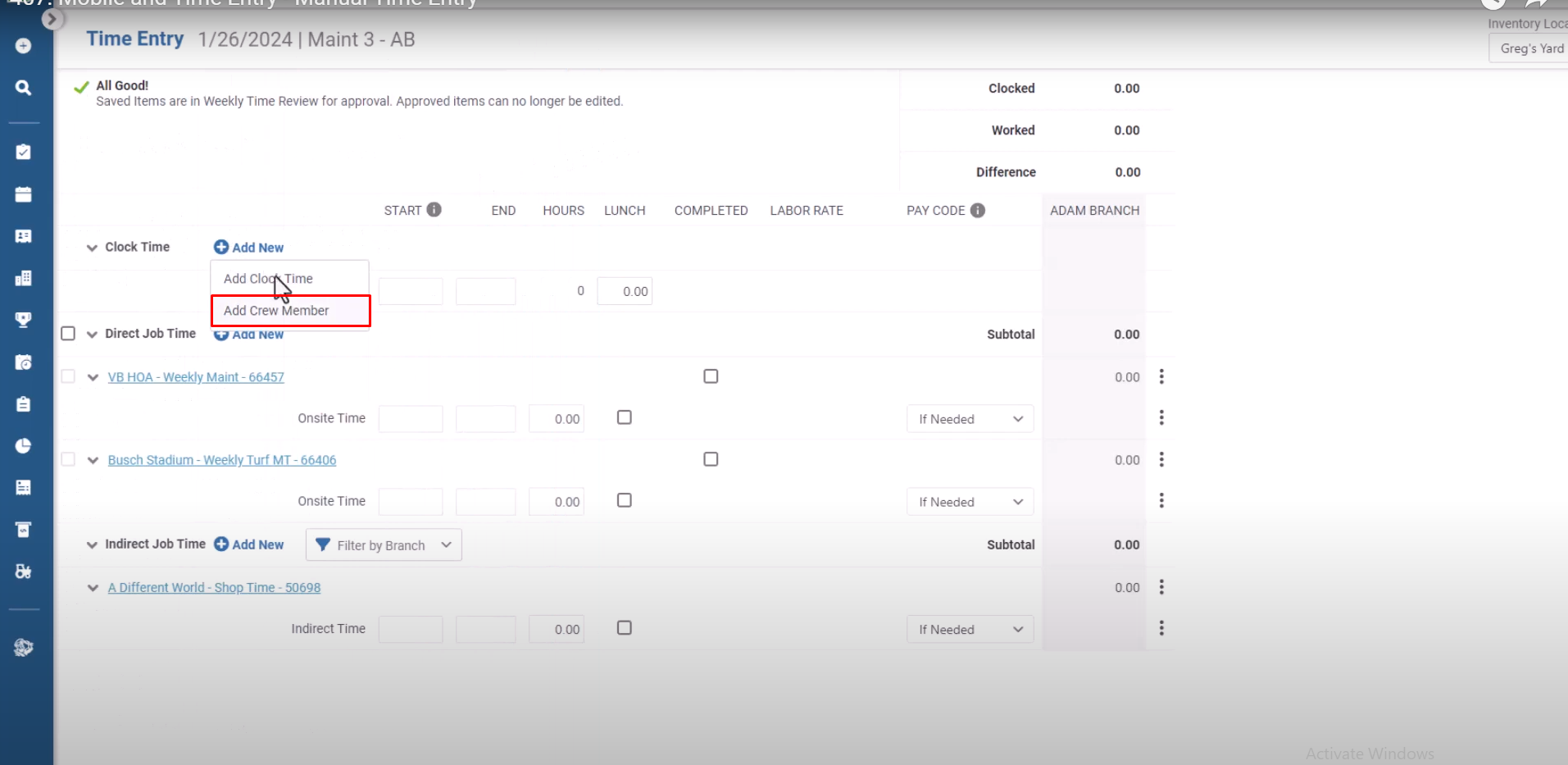

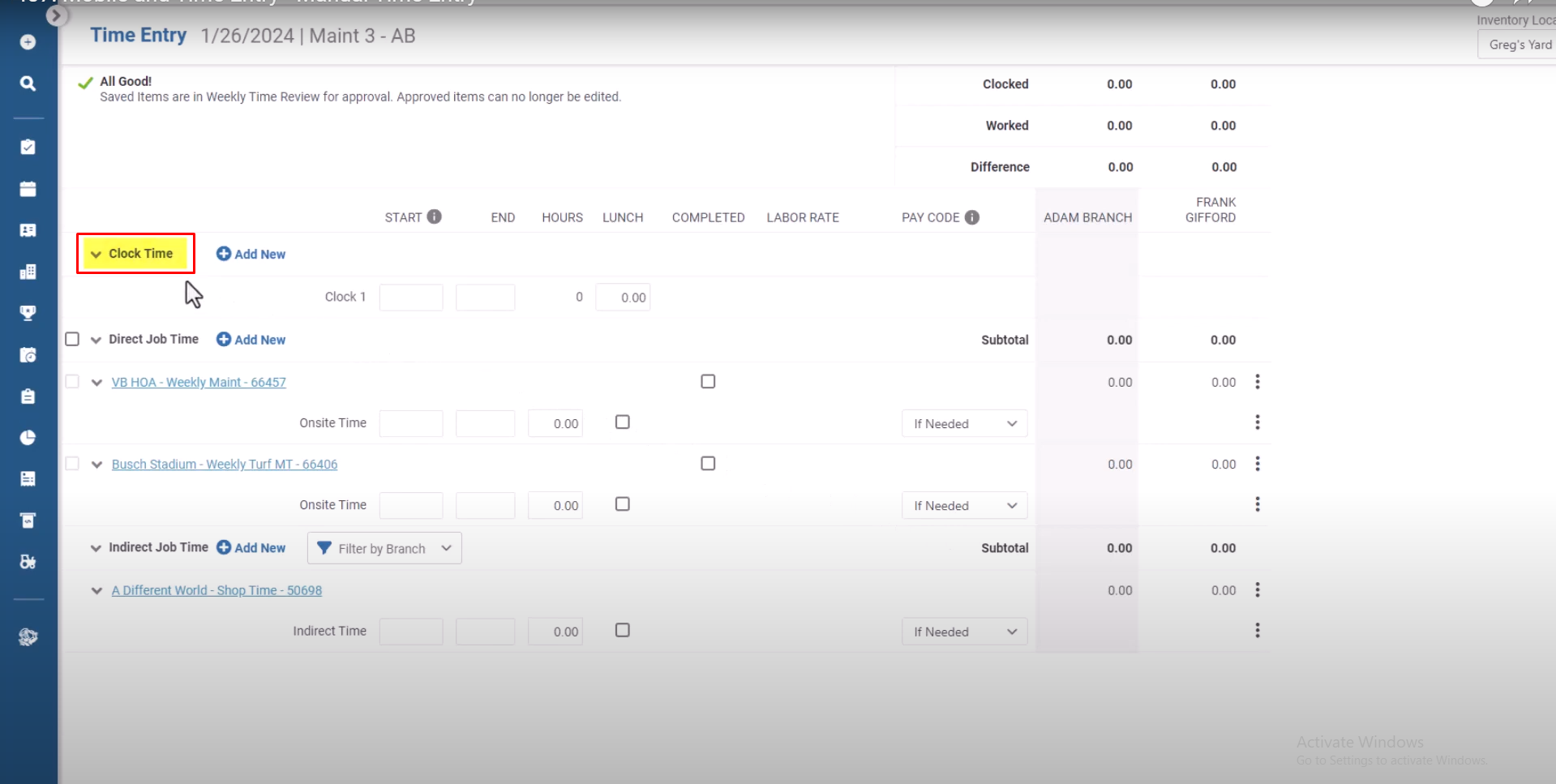

3. Add crew members by clicking the plus sign next to ‘Clock Time’ and selecting ‘Add Crew Member.’ Search and add employees.

4. Enter clock time in military format or use ‘a’ or ‘p’ for PM hours. Add time details for each employee.

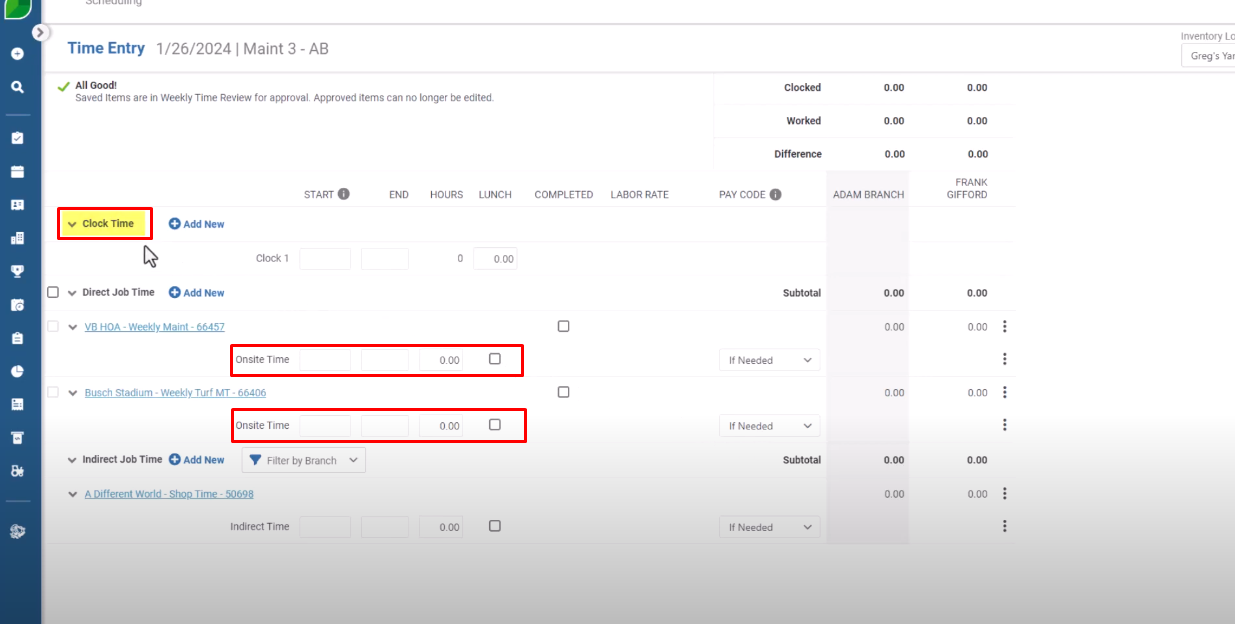

5. Add Direct Job Time for customer service by entering start and end times for each work ticket. Check the completed box when the work is done.

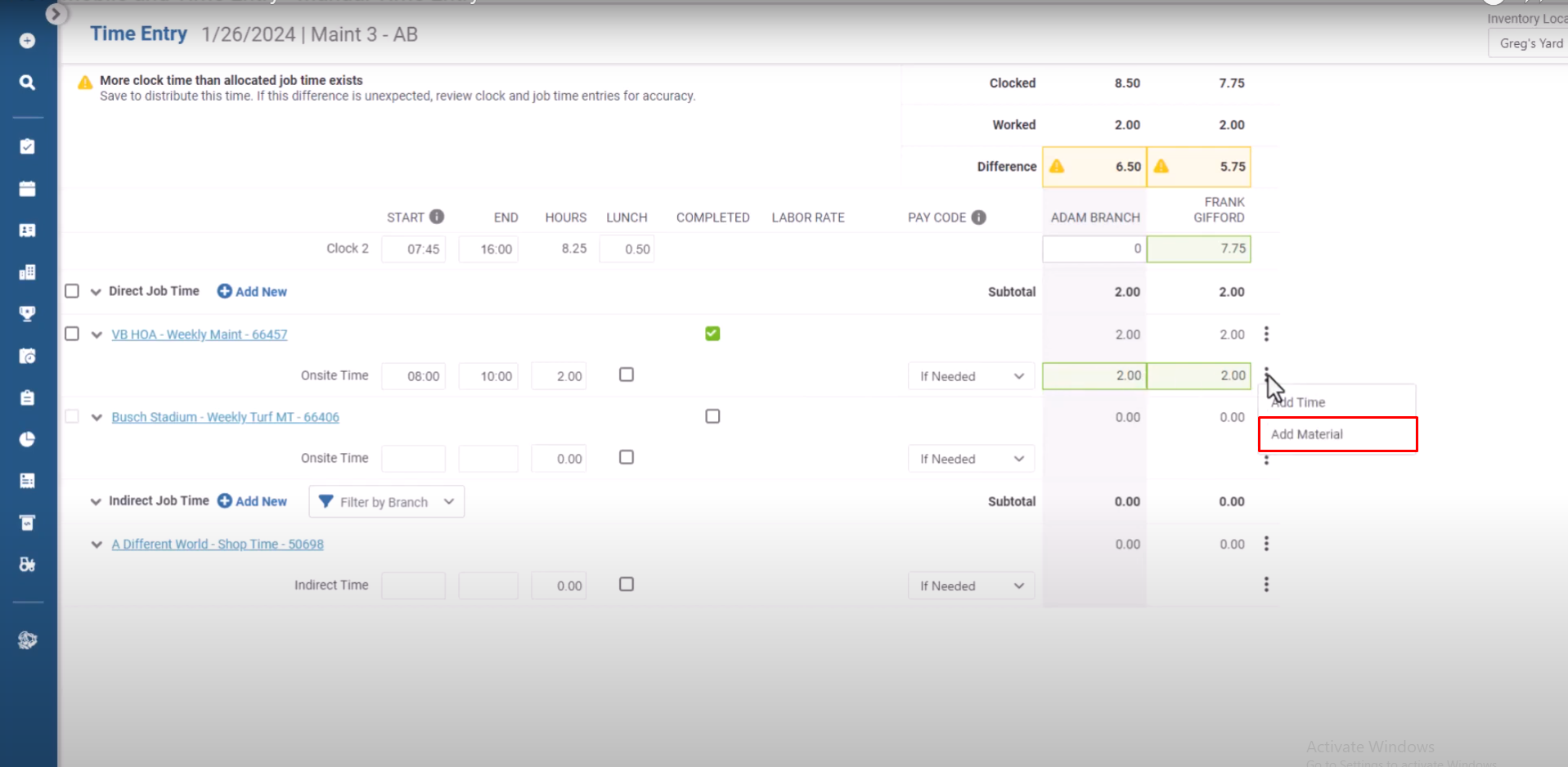

6. Add inventory items by clicking the three-dot menu, selecting ‘Add material,’ choosing items, and adding crew members. Enter quantities and save.

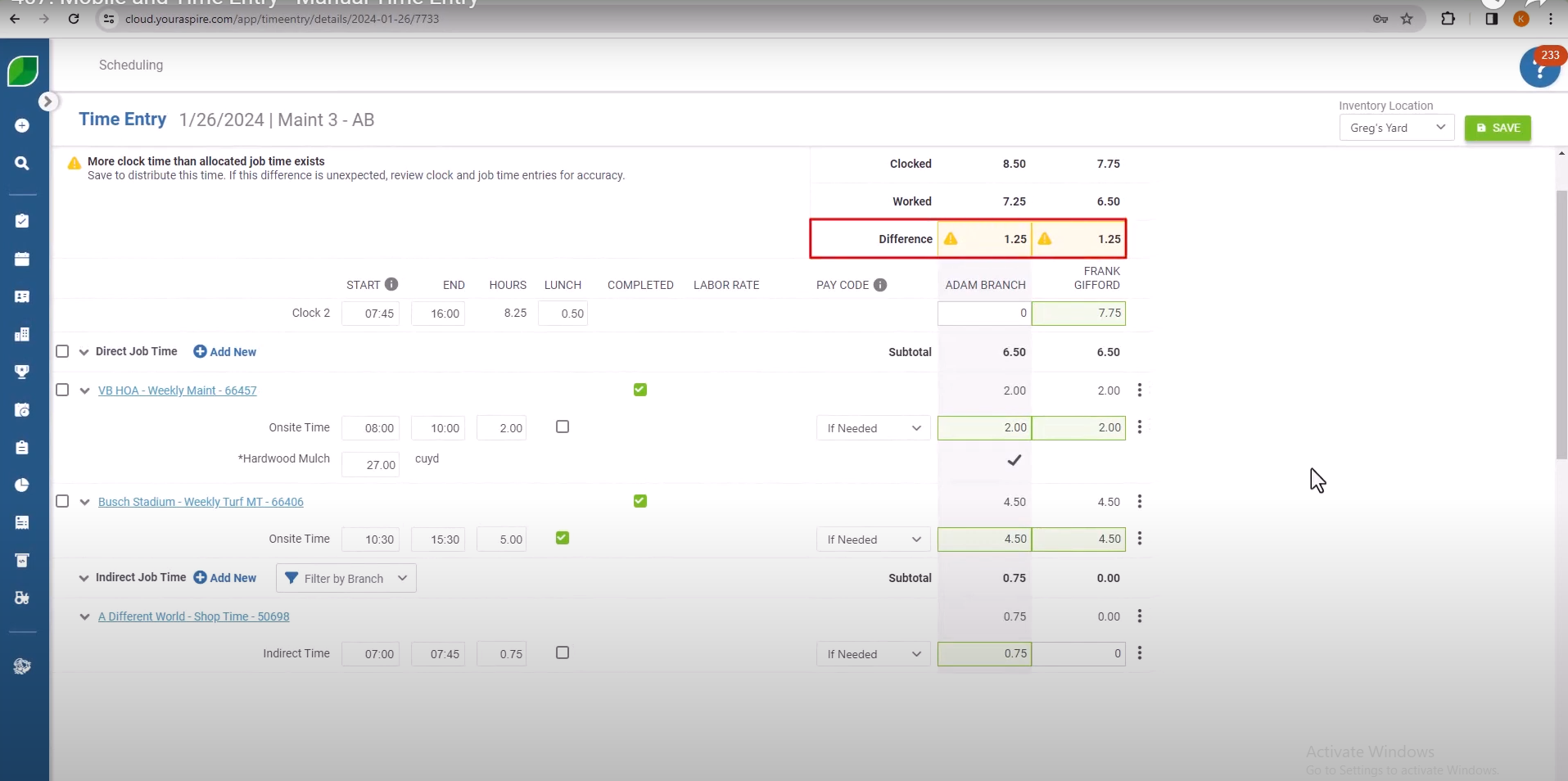

7. The ‘Difference’ time is distributed as ‘Drive Time’ on work tickets.

8. Click ‘Save’ in the top right corner to save the time entries for the day.

In conclusion, Aspire’s Manual Time Entry stands out as an essential feature, offering users unparalleled flexibility and accuracy in time tracking. Its offline capabilities ensure seamless recording of work hours, overcoming connectivity challenges. The user-friendly interface empowers individuals to manage and document their time efficiently, contributing to the overall convenience and reliability of the Aspire platform.

With the ability to correct errors in real-time during mobile tracking and effortlessly adjust time on work tickets, Aspire enhances precision and accountability in project management. This streamlined process not only benefits employees by ensuring accurate pay but also ensures precise billing for customers. Aspire’s Manual Time Entry is a key element for efficient time management and project success.

Download the PDF Version of the Job Aide Here.