Cash flow is the lifeblood of any business, and landscape companies are no exception. With seasonal fluctuations, high upfront costs, and varying payment timelines, managing cash flow effectively is crucial for sustainability and growth. Here are some actionable strategies landscape businesses can adopt to improve their cash flow:

1. Require Deposits for Large Projects

One of the most effective ways to improve cash flow is by requiring upfront deposits for significant projects. According to Entrepreneur, collecting a deposit not only helps cover initial expenses like materials and labor but also ensures client commitment. Standard practice involves requesting 25-50% of the project cost as a deposit.

- Tip: Make deposit requirements a part of your contract. Clearly communicate these terms during the proposal stage to avoid surprises.

2. Negotiate Terms with Vendors

Securing favorable payment terms with vendors can alleviate cash flow pressure. For example, negotiating a 30- or 60-day payment window allows you to complete projects and invoice clients before paying for materials. Some vendors may also offer early payment discounts, which can save money if cash flow permits.

- Example: A landscape company that secures 60-day terms for materials while invoicing clients on net-30 terms creates a cushion for smoother operations.

3. Invoice Promptly and Consistently

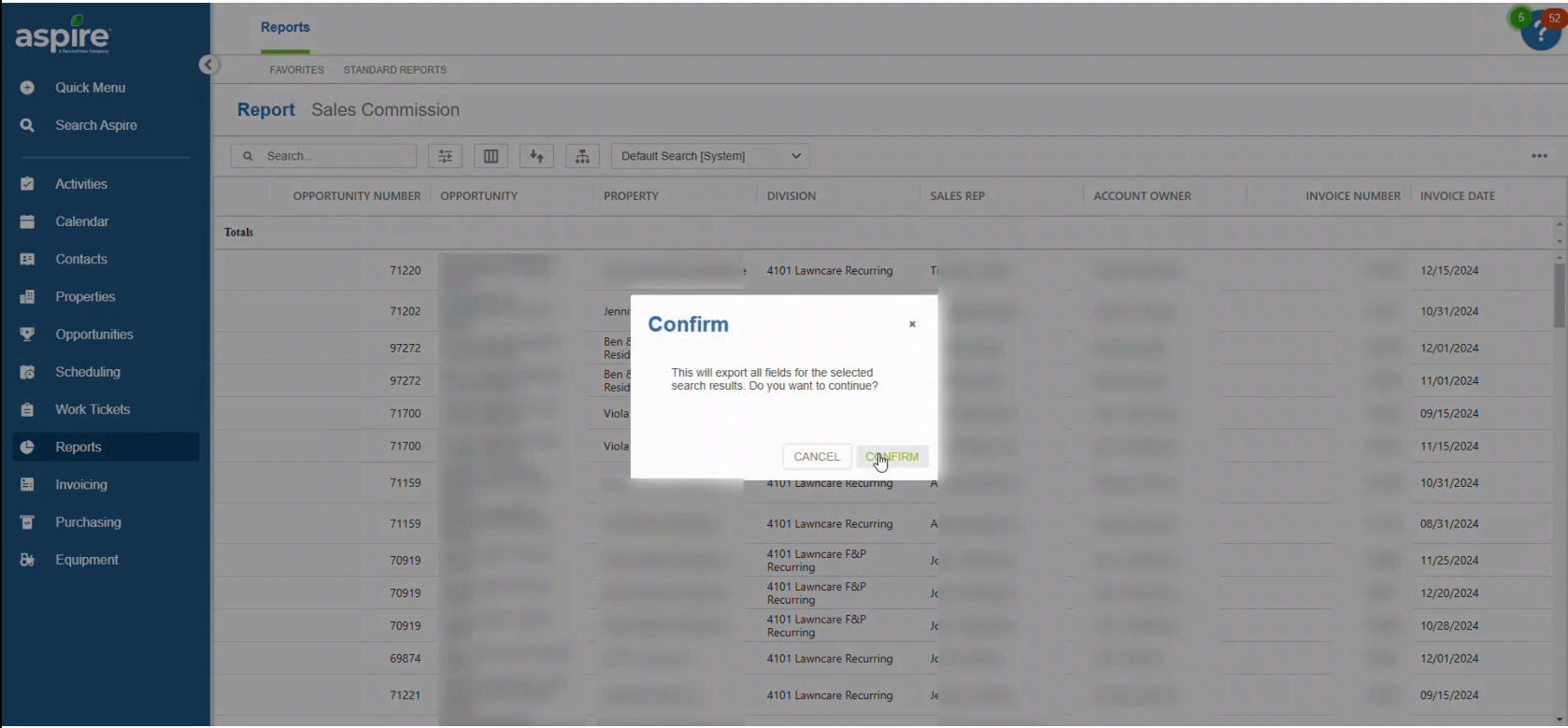

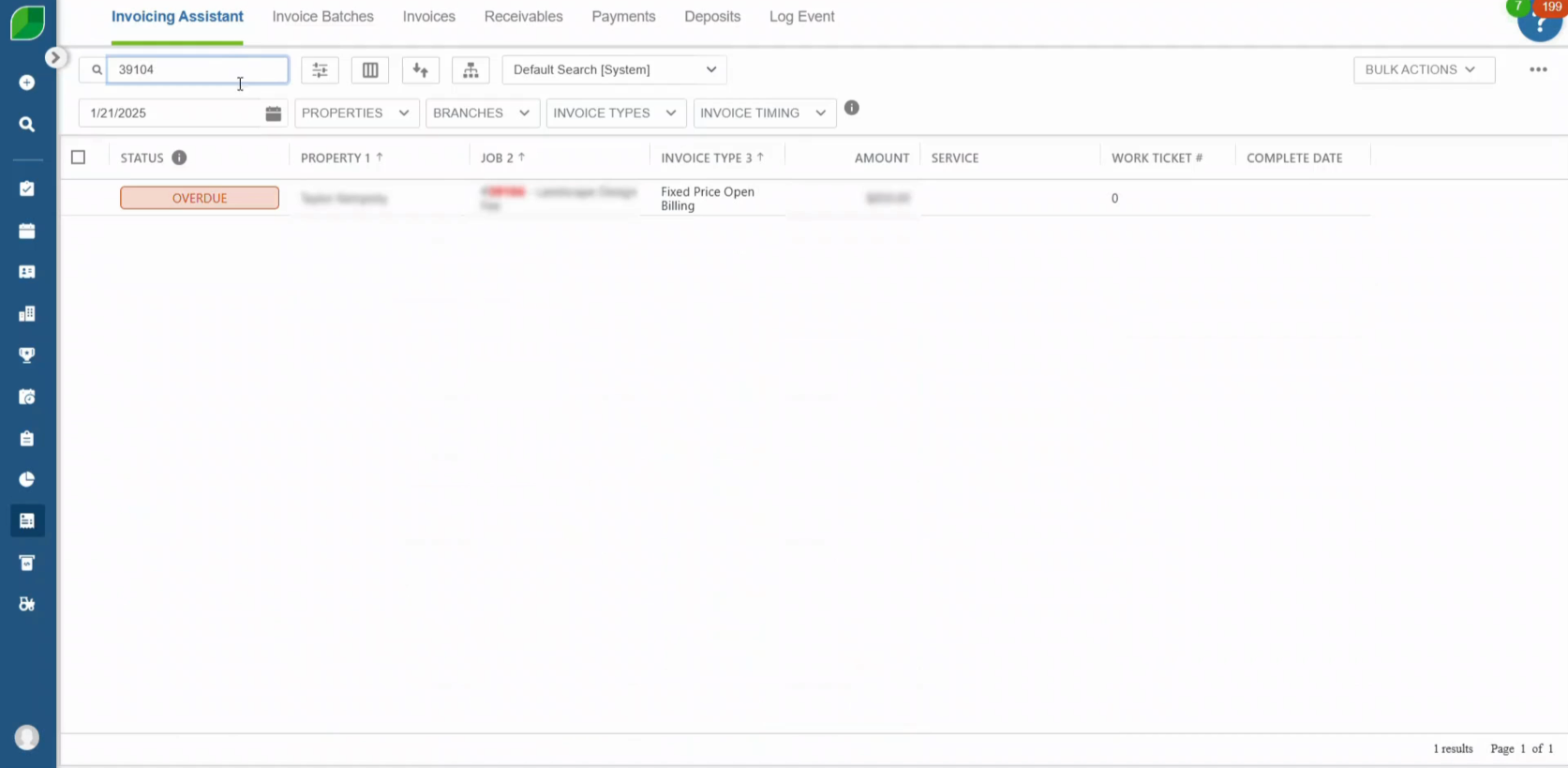

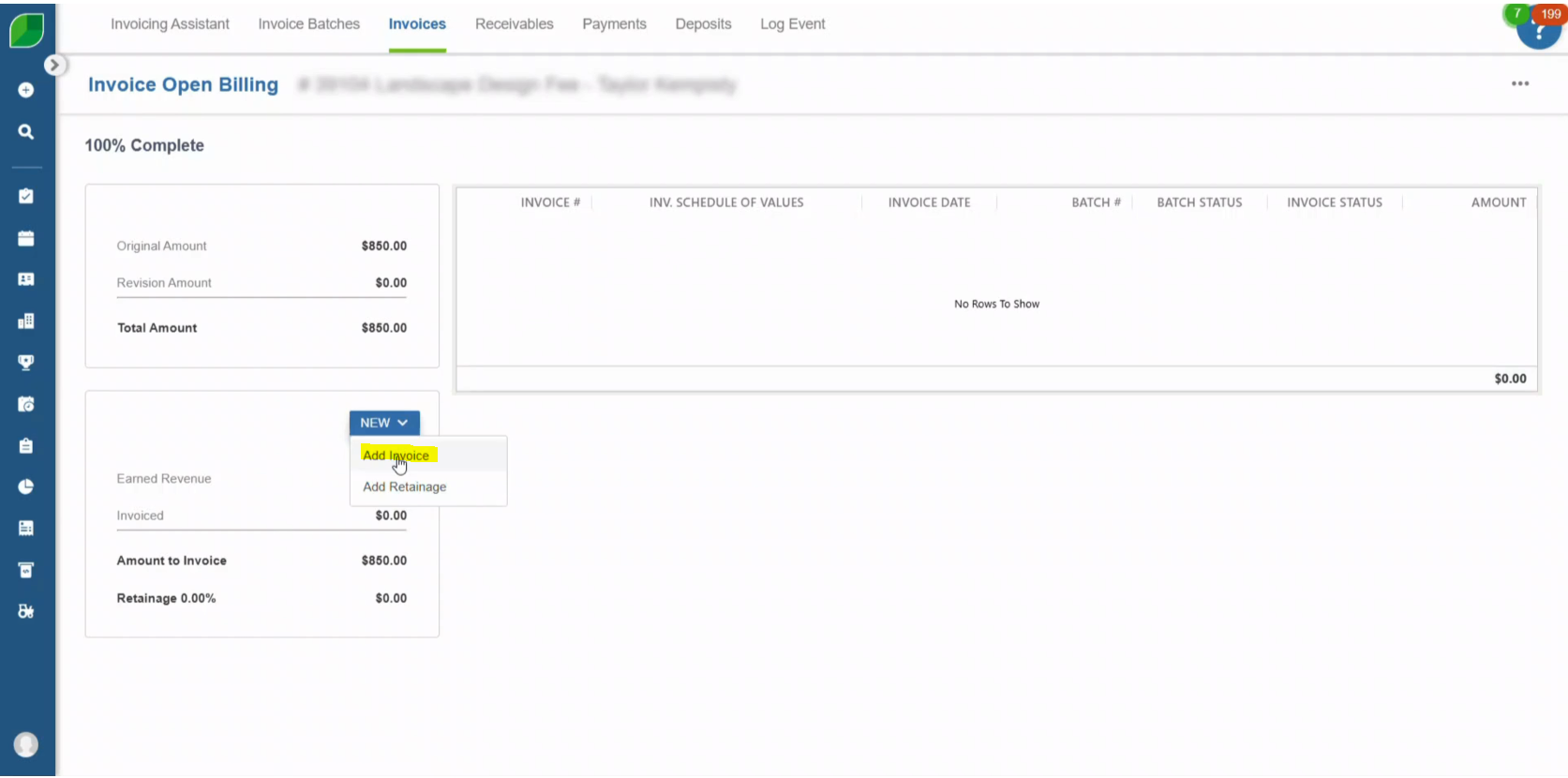

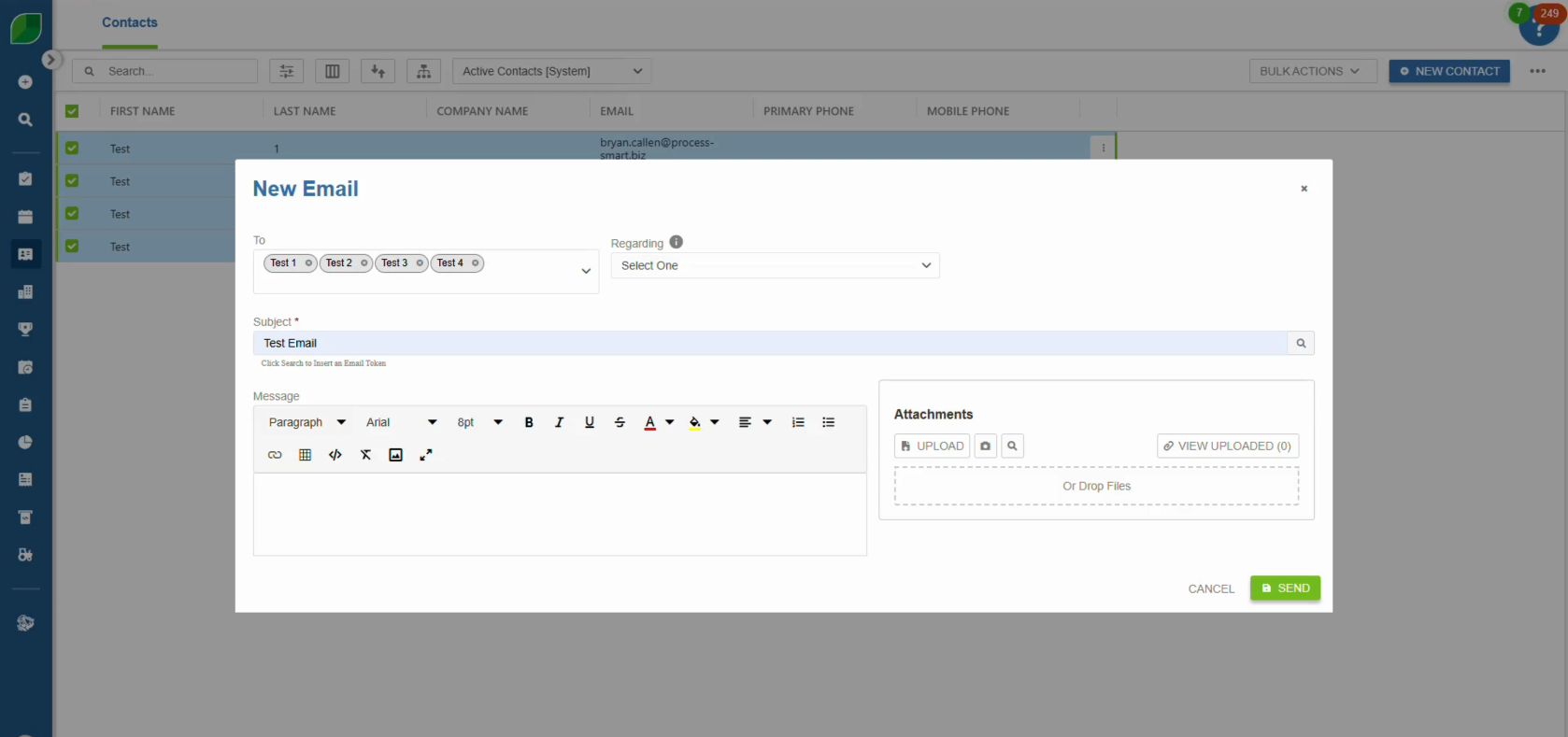

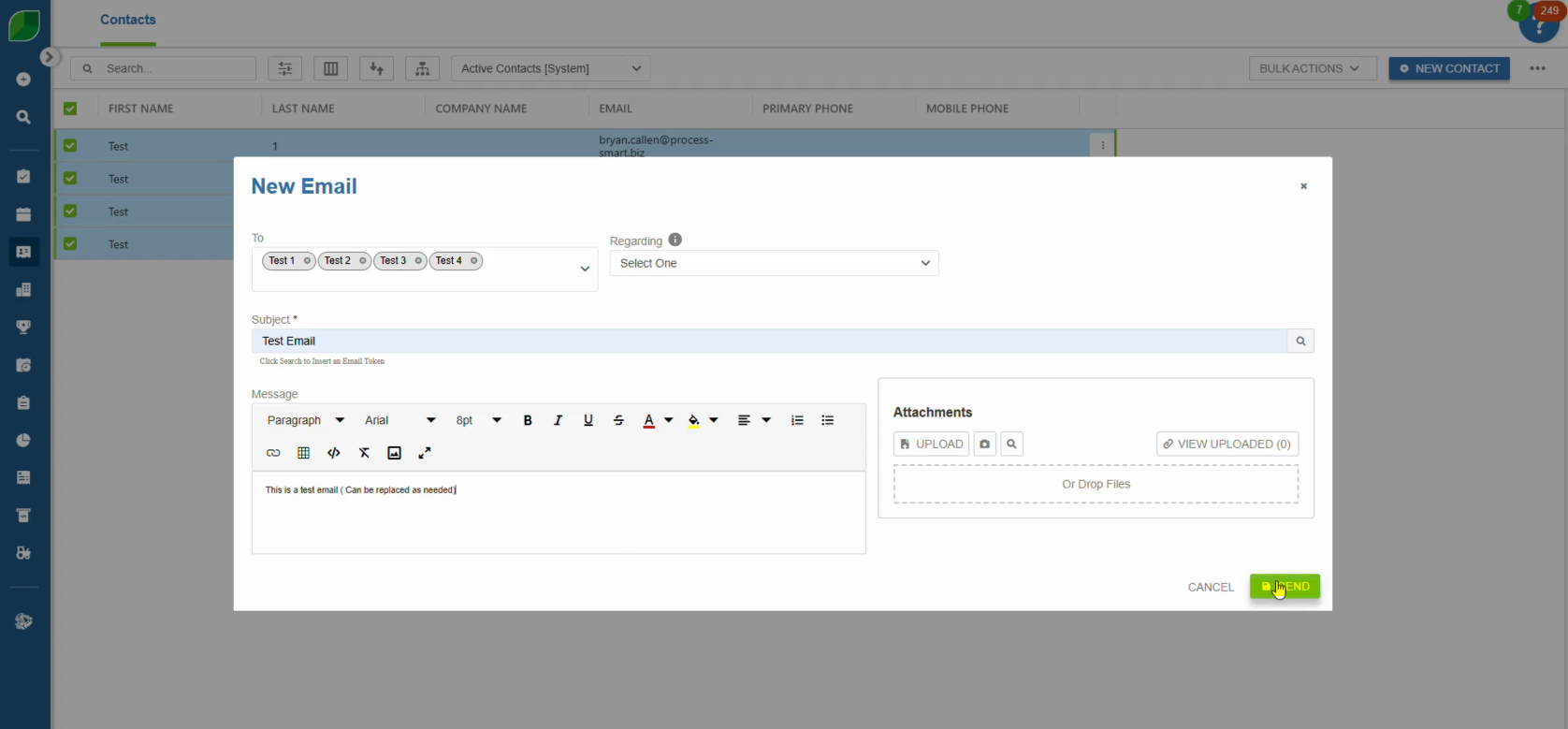

Delayed invoicing often leads to delayed payments. Implement a system to send invoices immediately after completing work or reaching project milestones. Tools like QuickBooks or LMN can automate this process and even send reminders for overdue payments.

- Pro Tip: Include clear payment terms and due dates on every invoice. Offering multiple payment options—credit card, ACH transfer, or checks—can also expedite payments.

4. Offer Incentives for Early Payments

Encourage clients to pay ahead of schedule by offering small discounts for early payments. For instance, providing a 2% discount for payments received within 10 days can motivate timely action.

- Reference: The “2/10 Net 30” payment term, commonly used in various industries, rewards early payers while still giving others up to 30 days to pay.

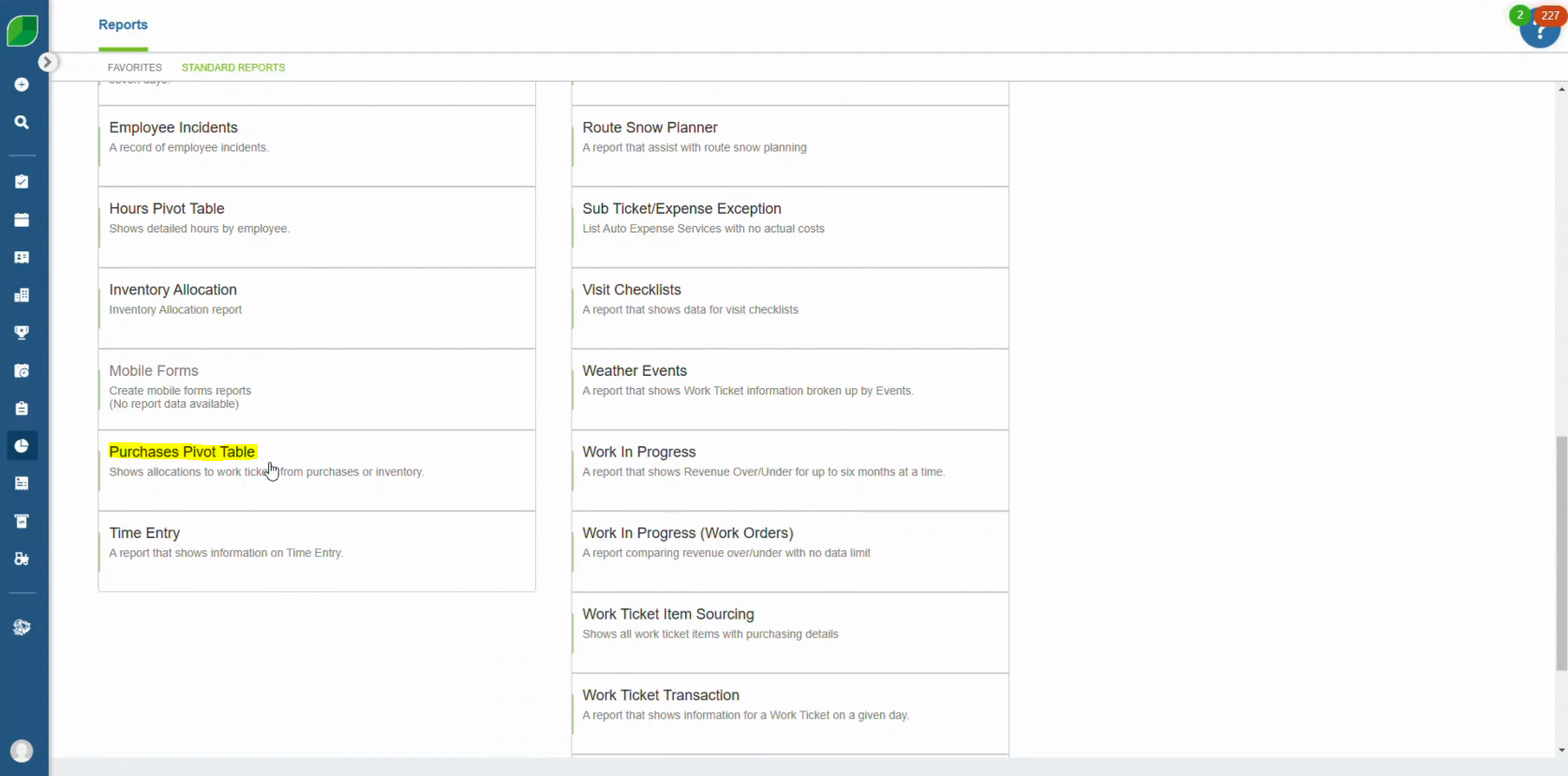

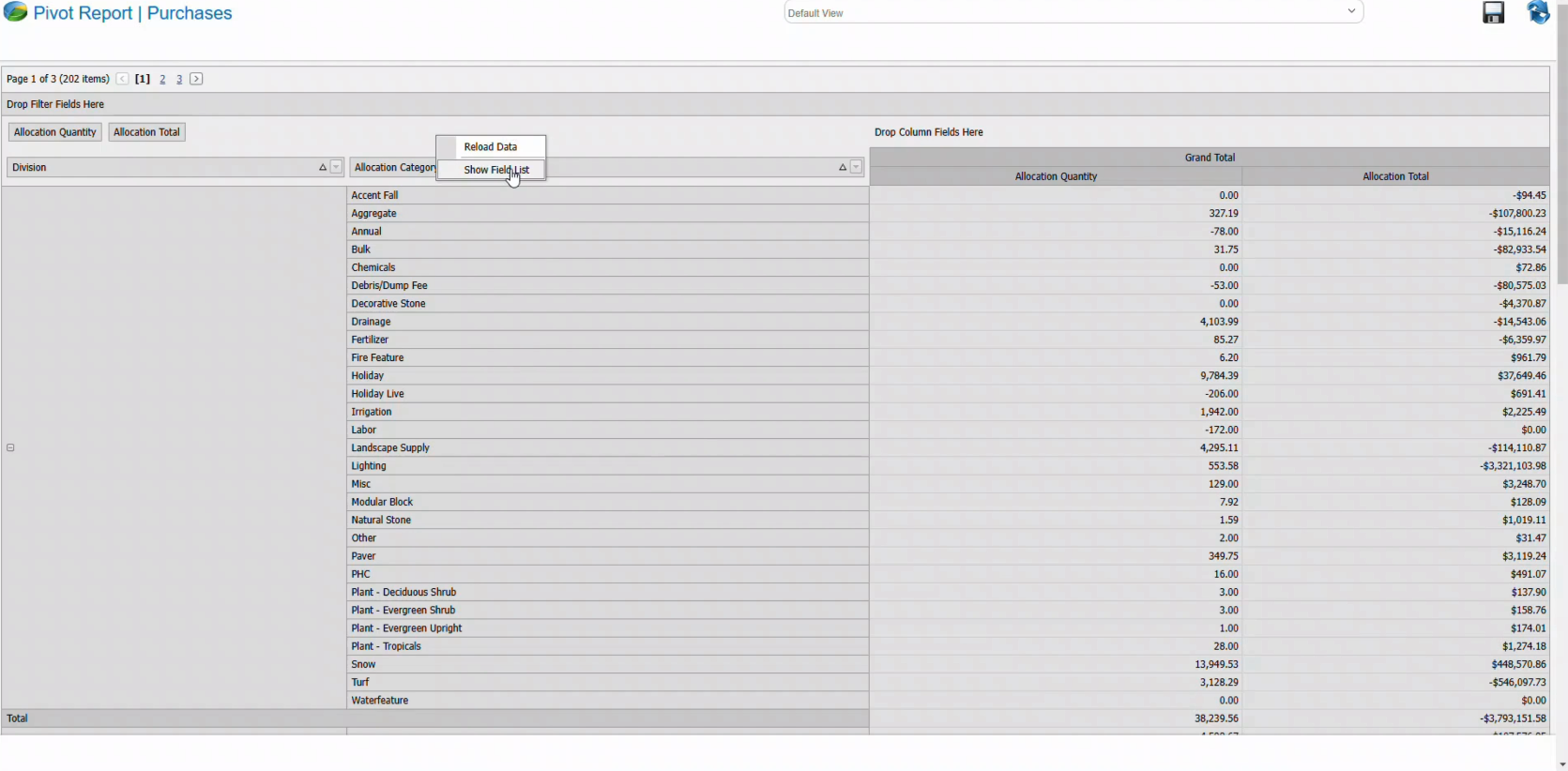

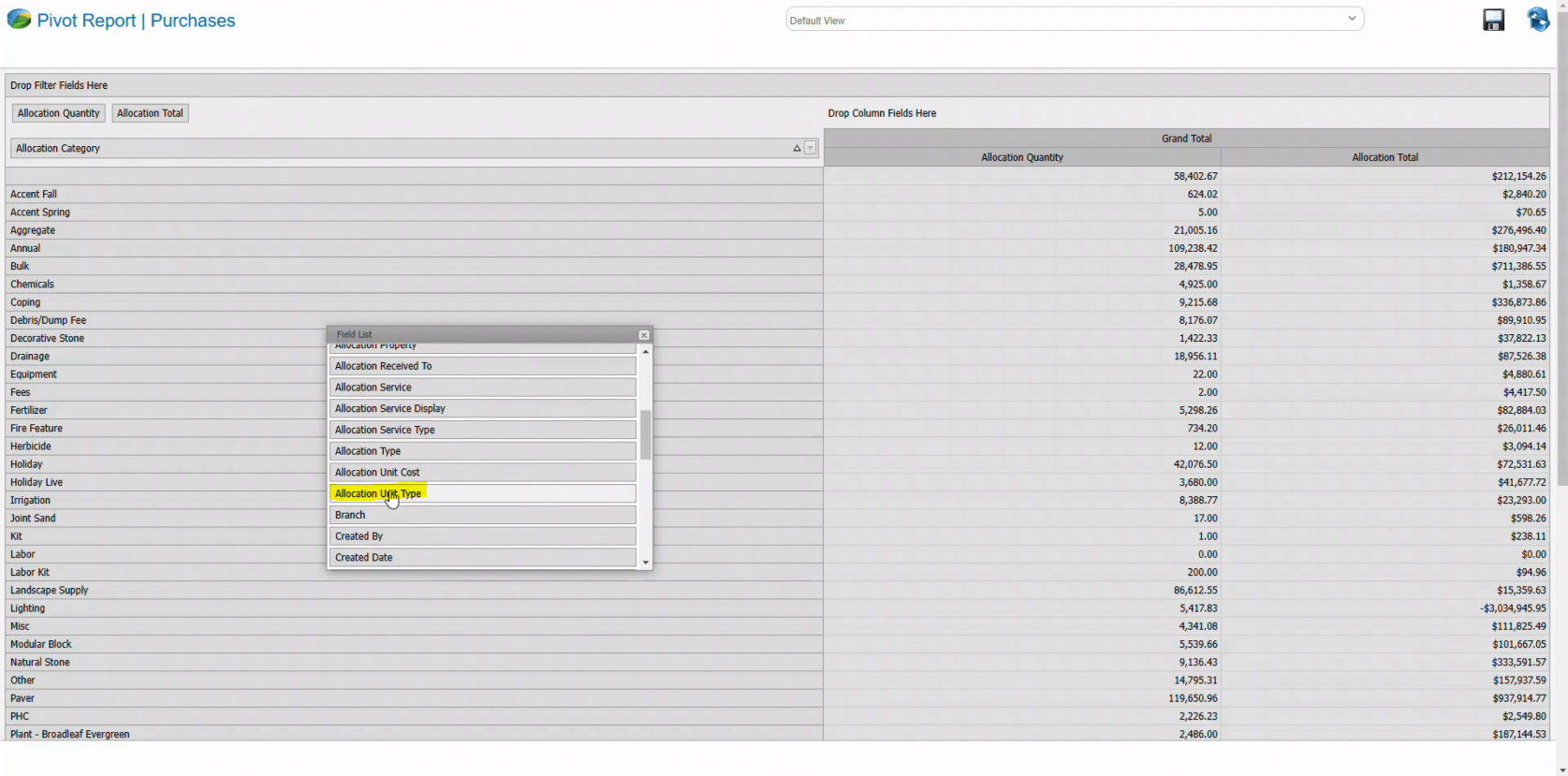

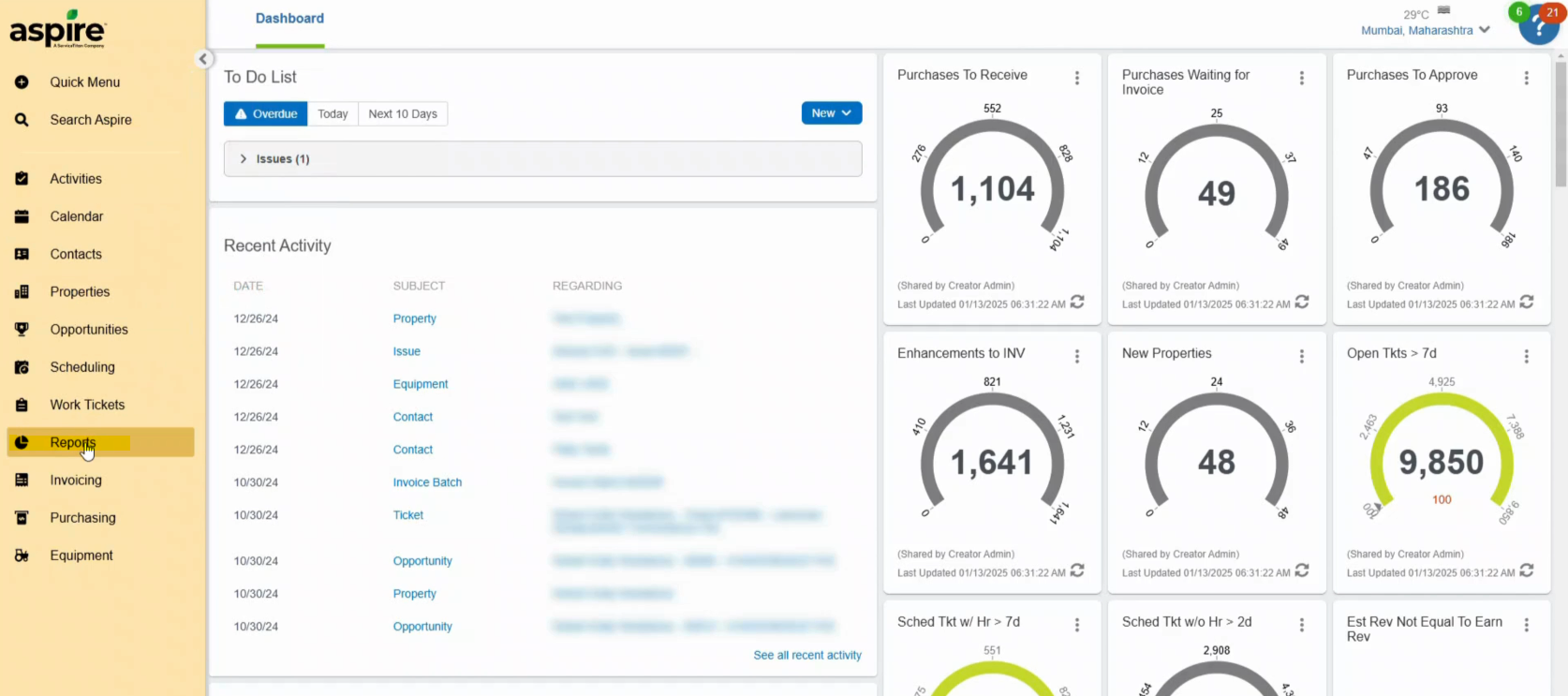

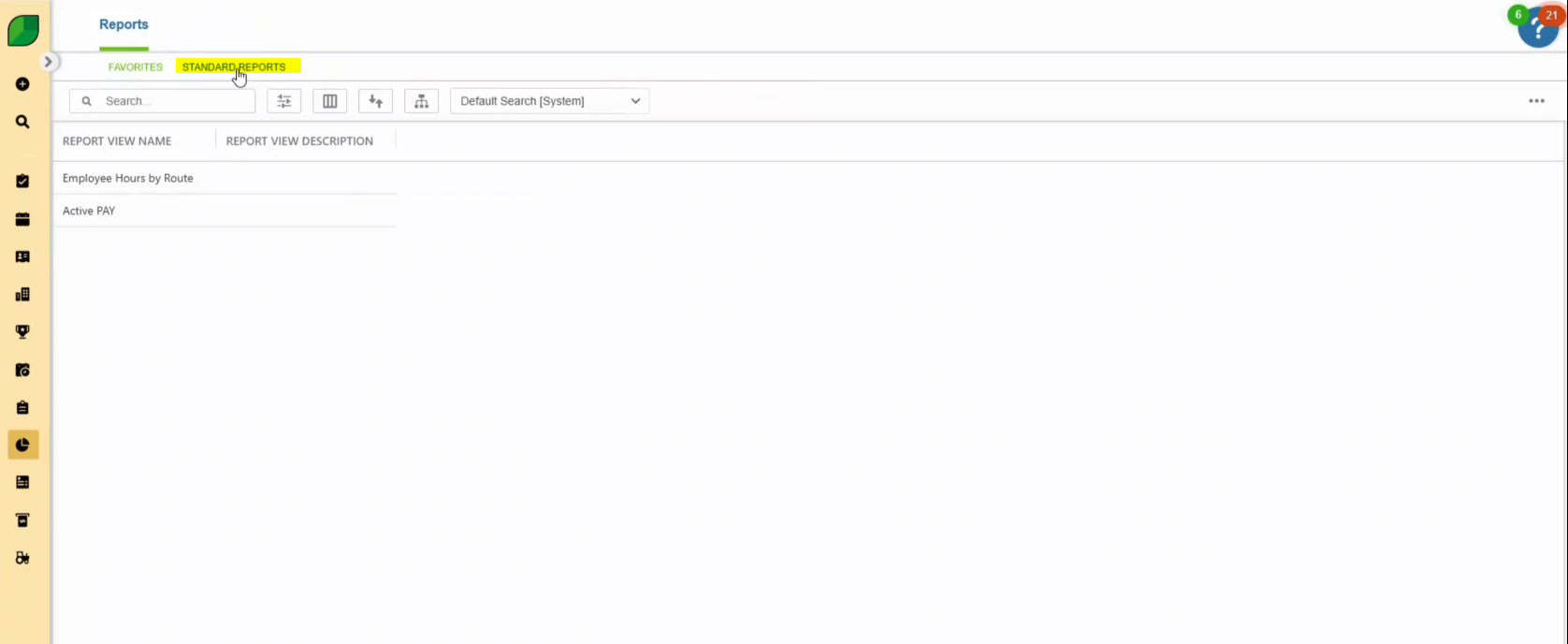

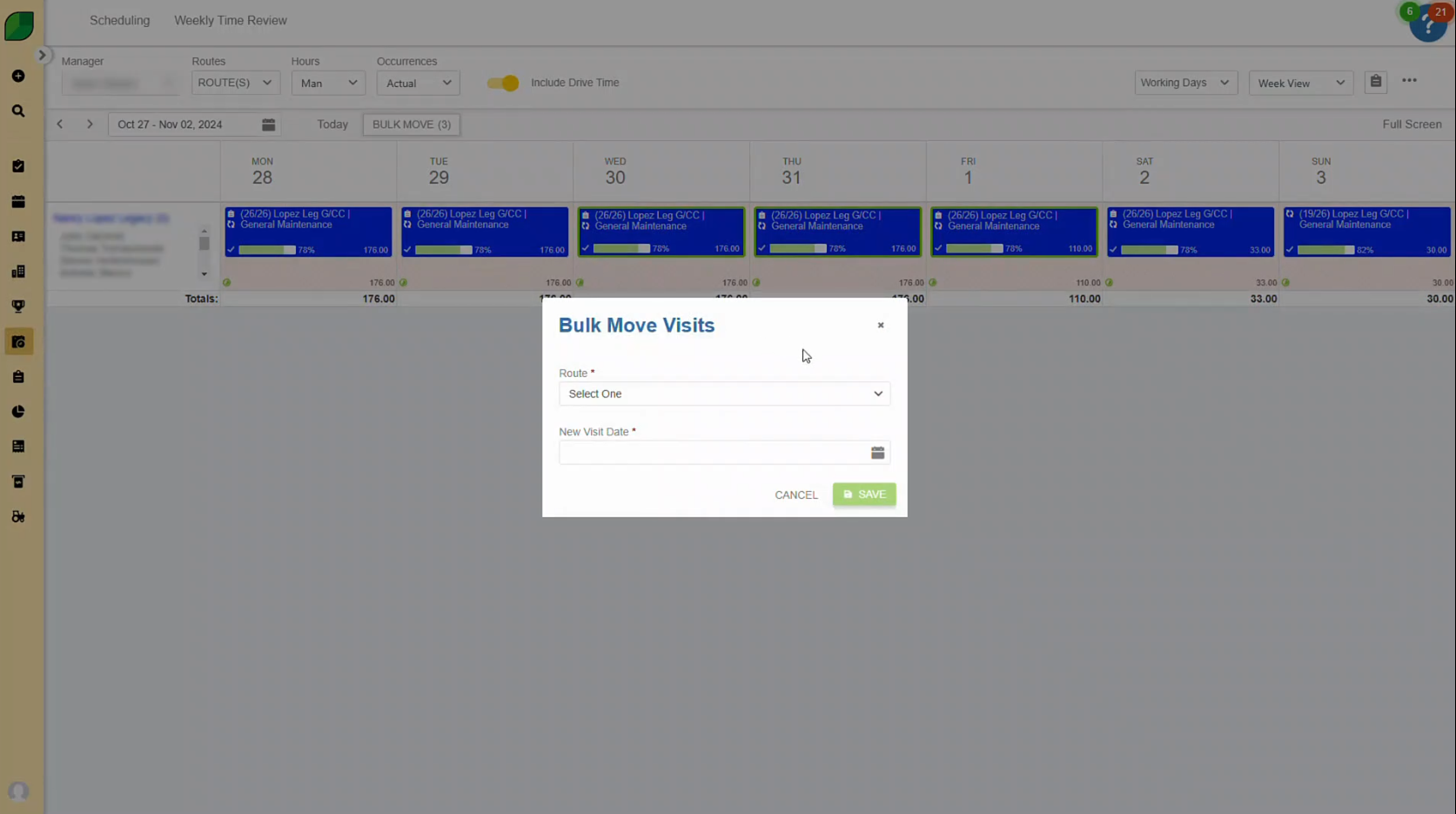

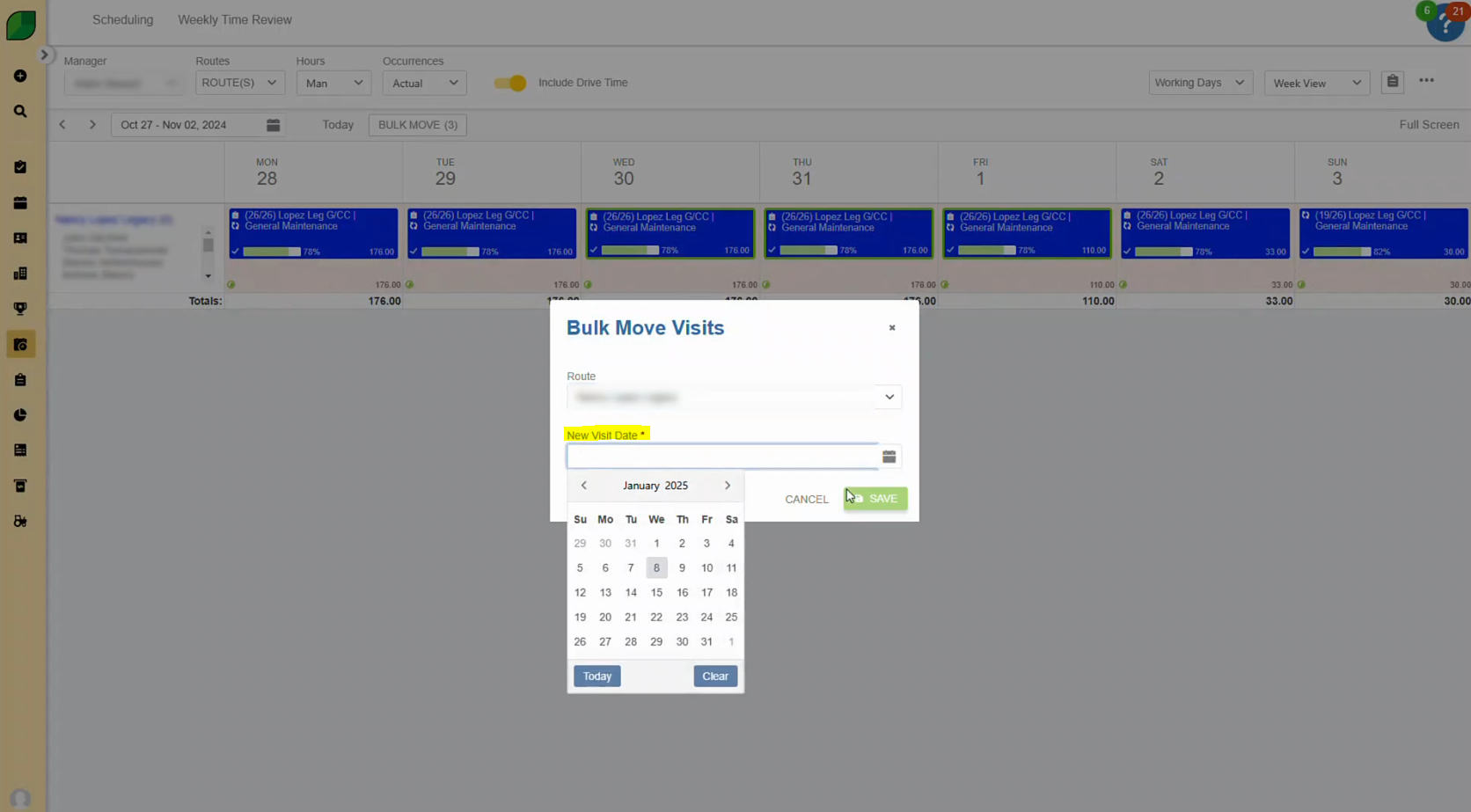

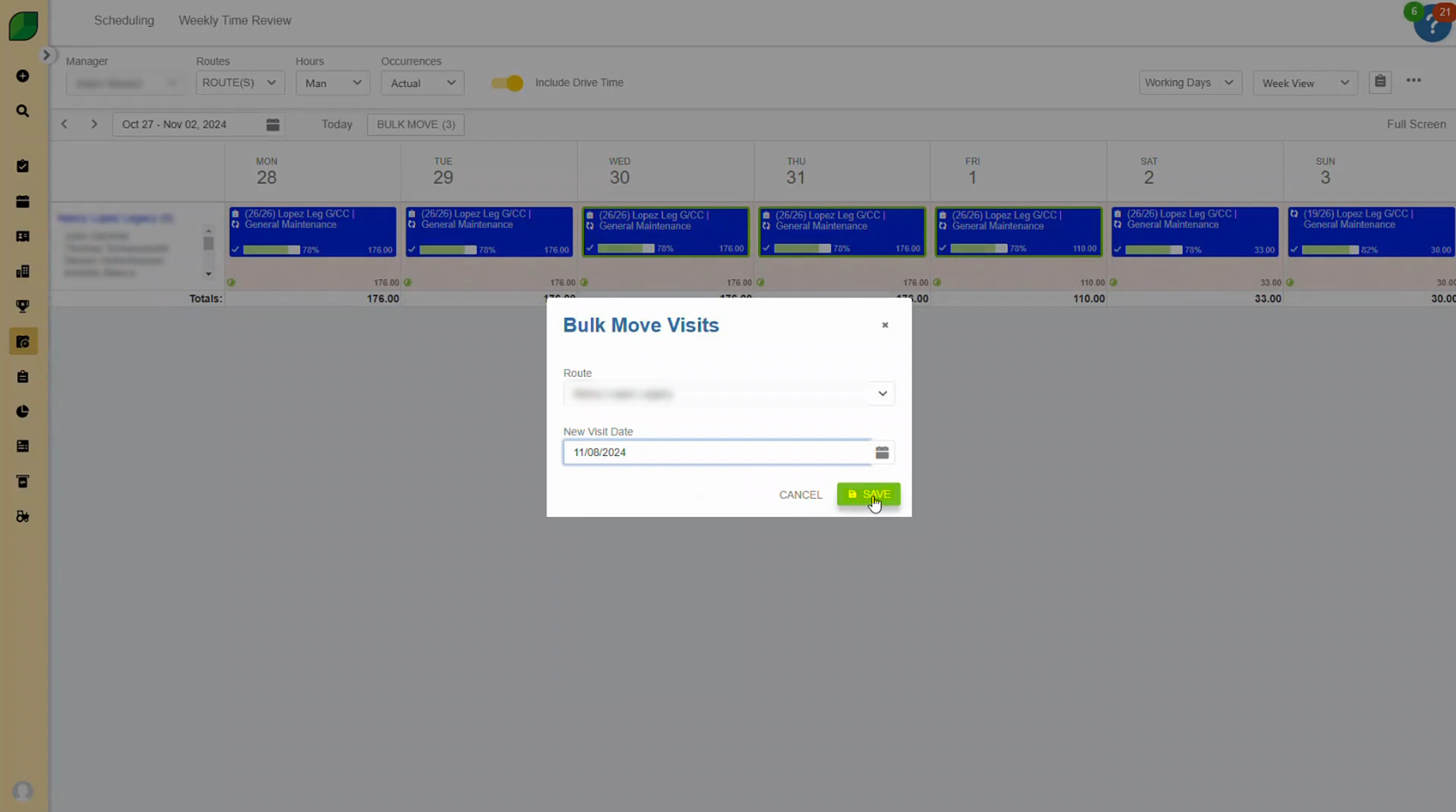

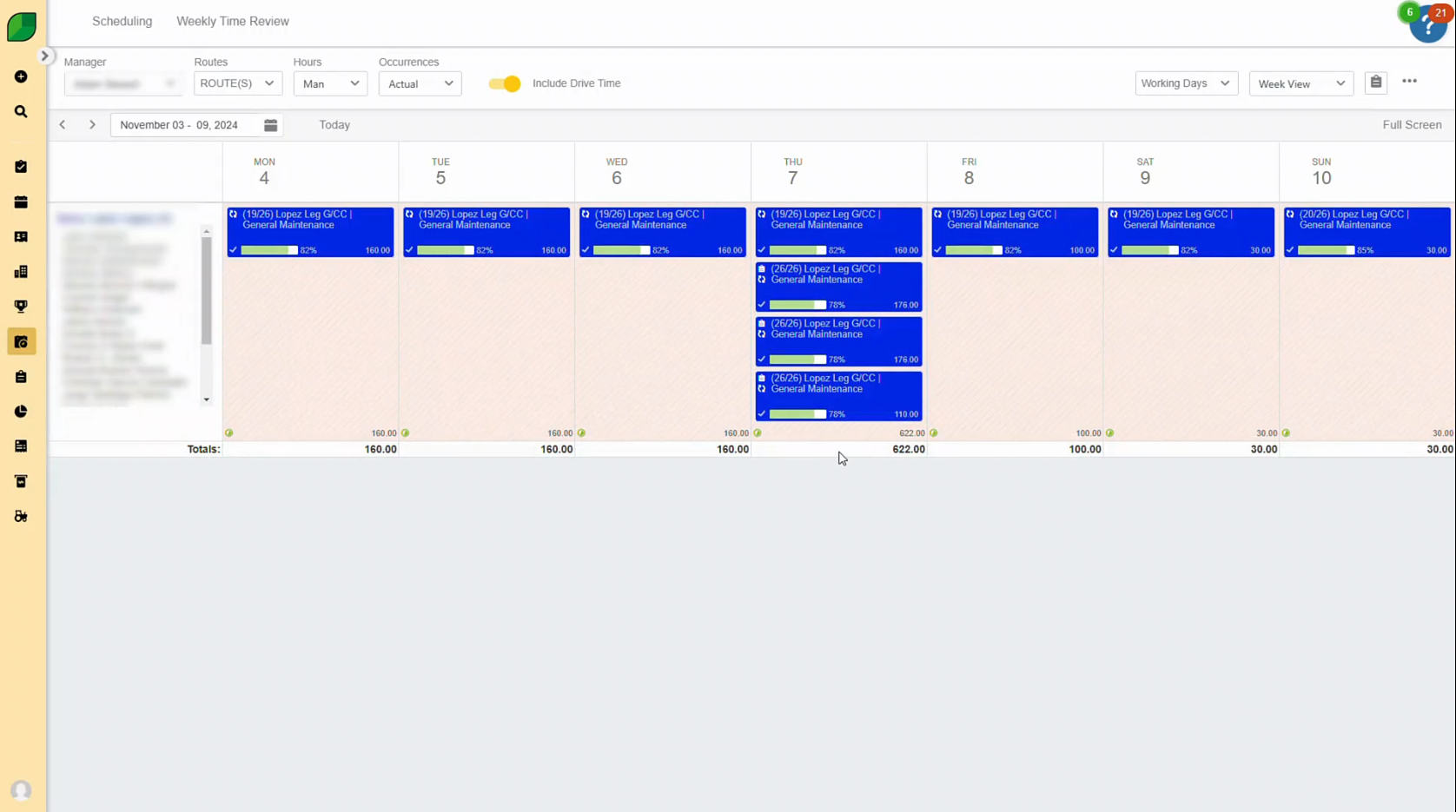

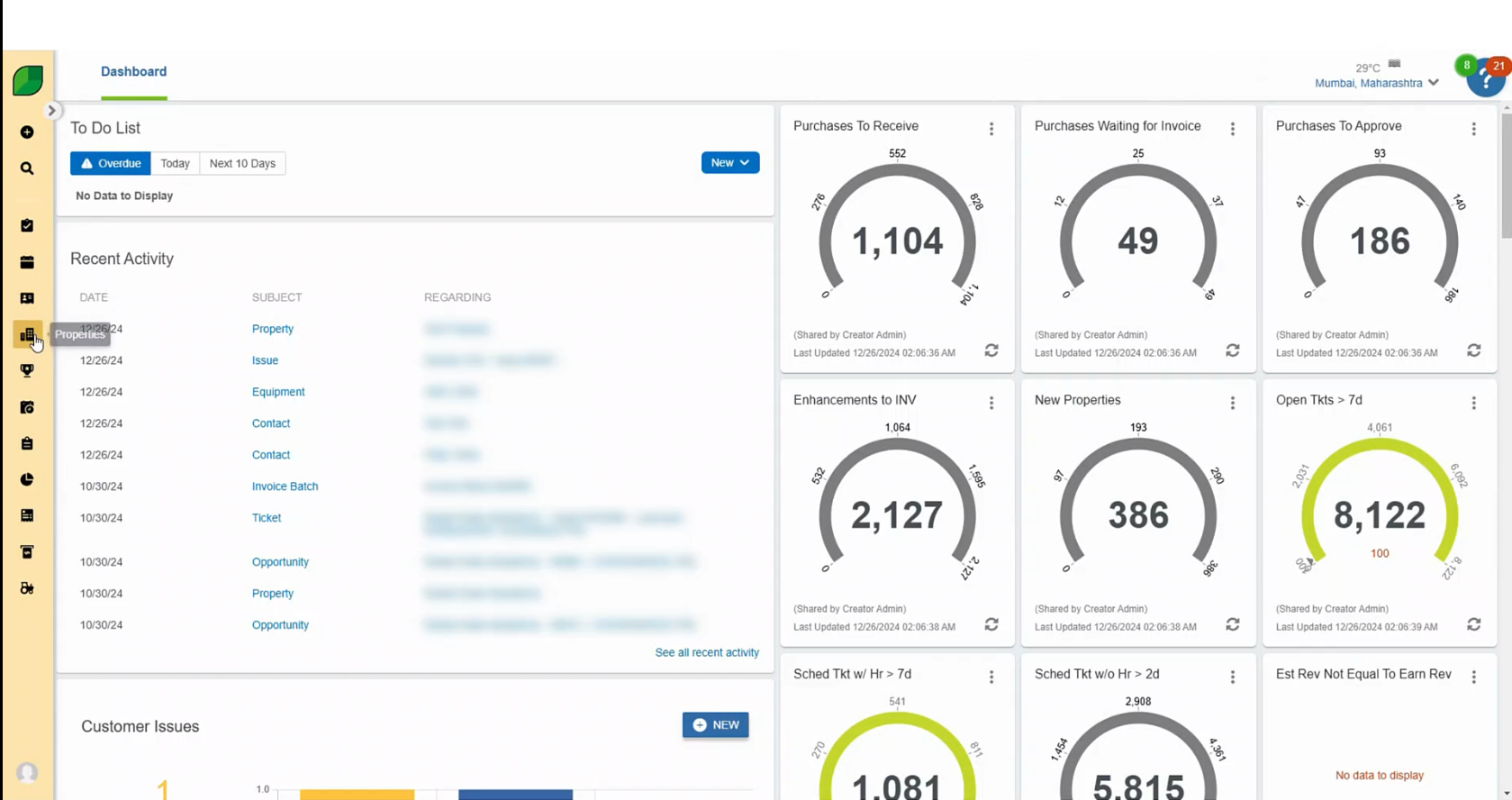

5. Optimize Scheduling and Resource Utilization

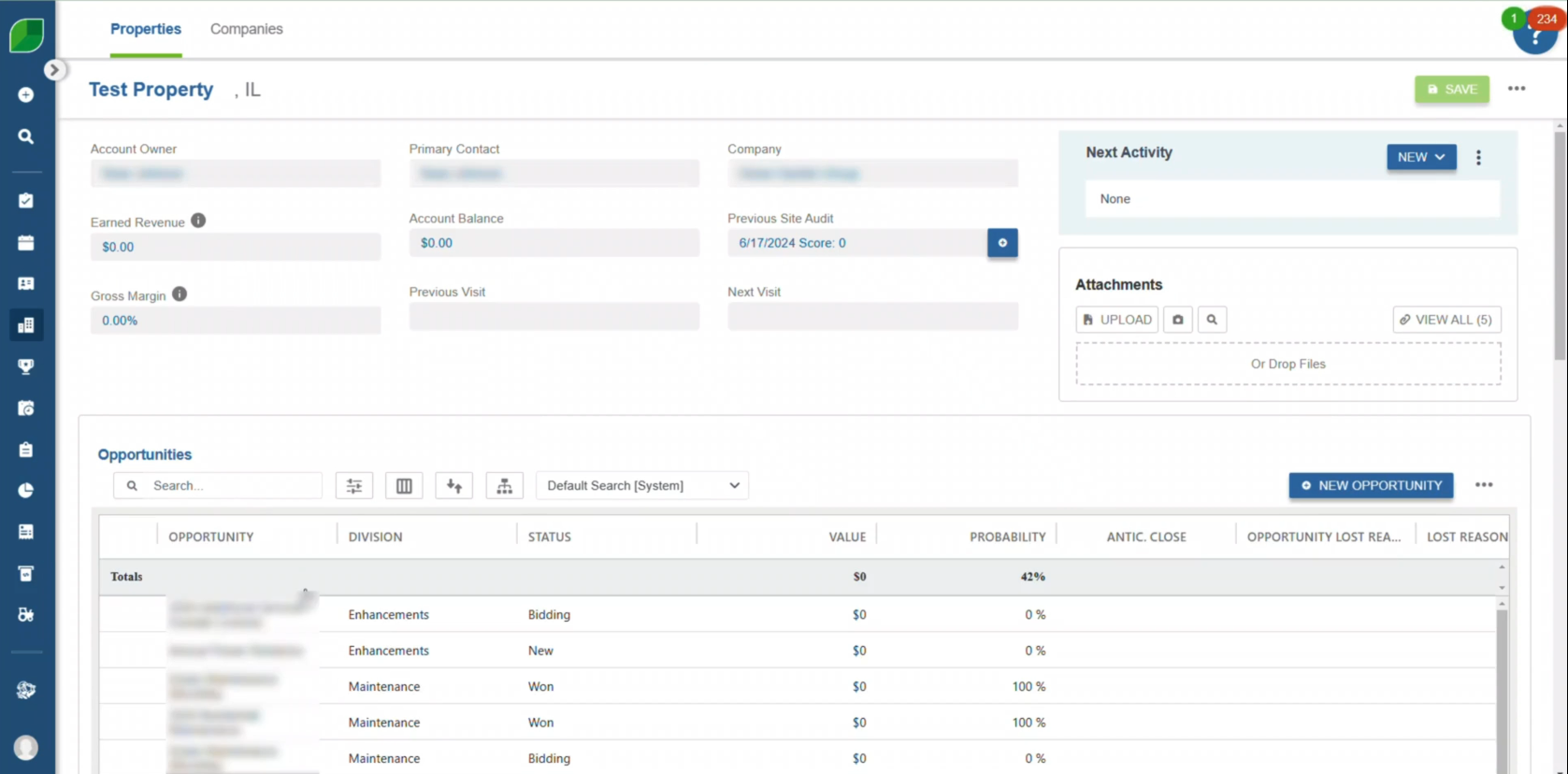

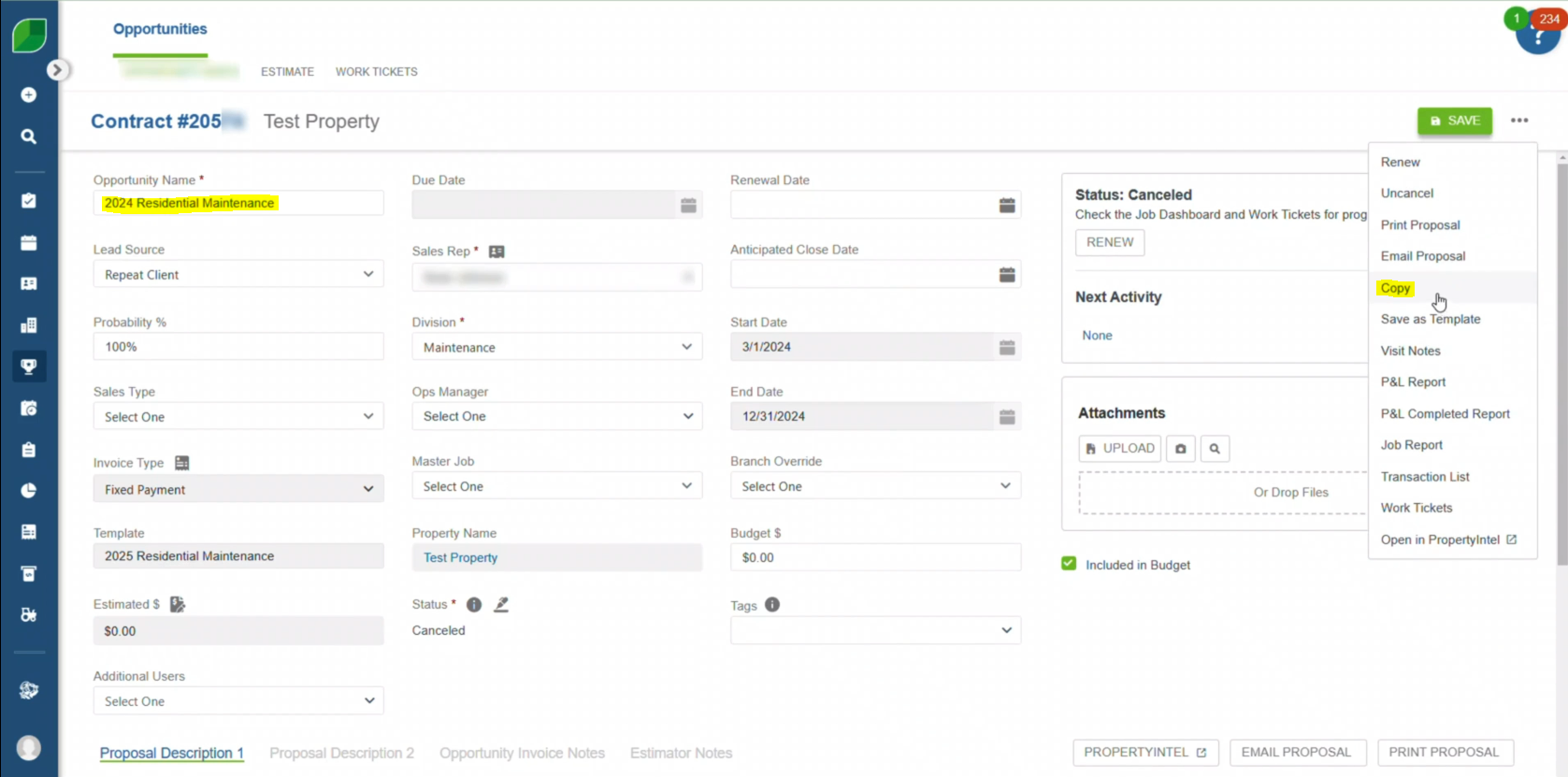

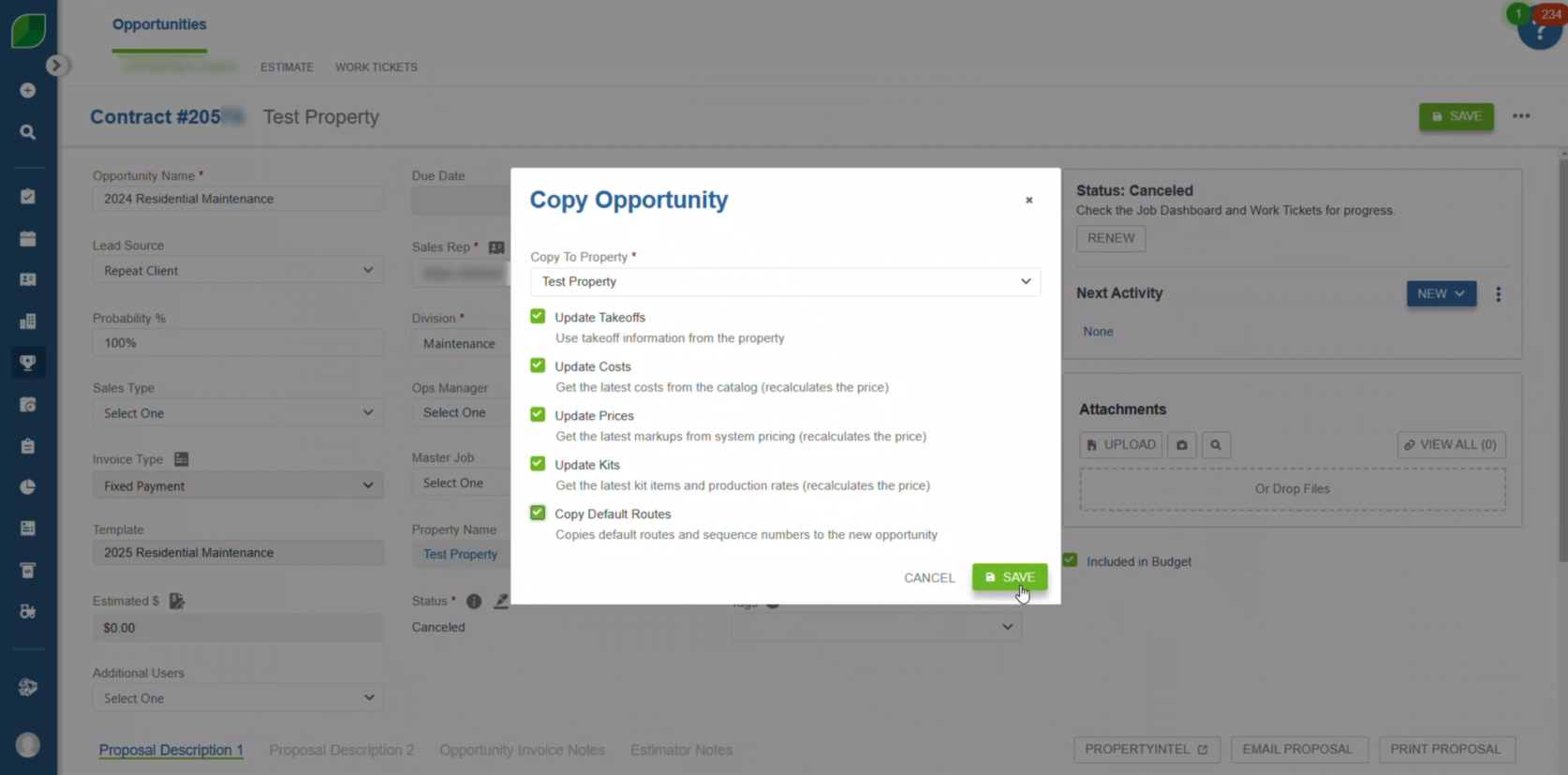

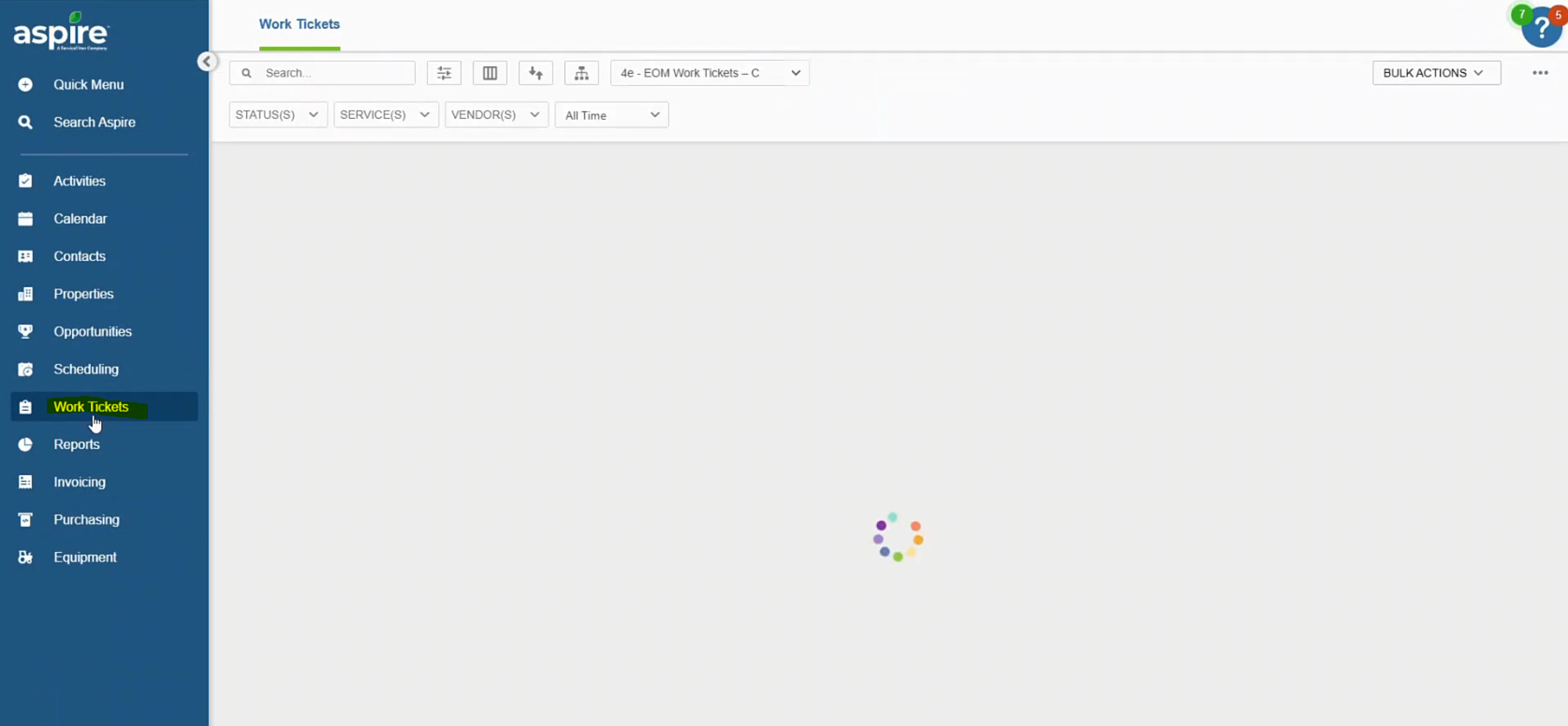

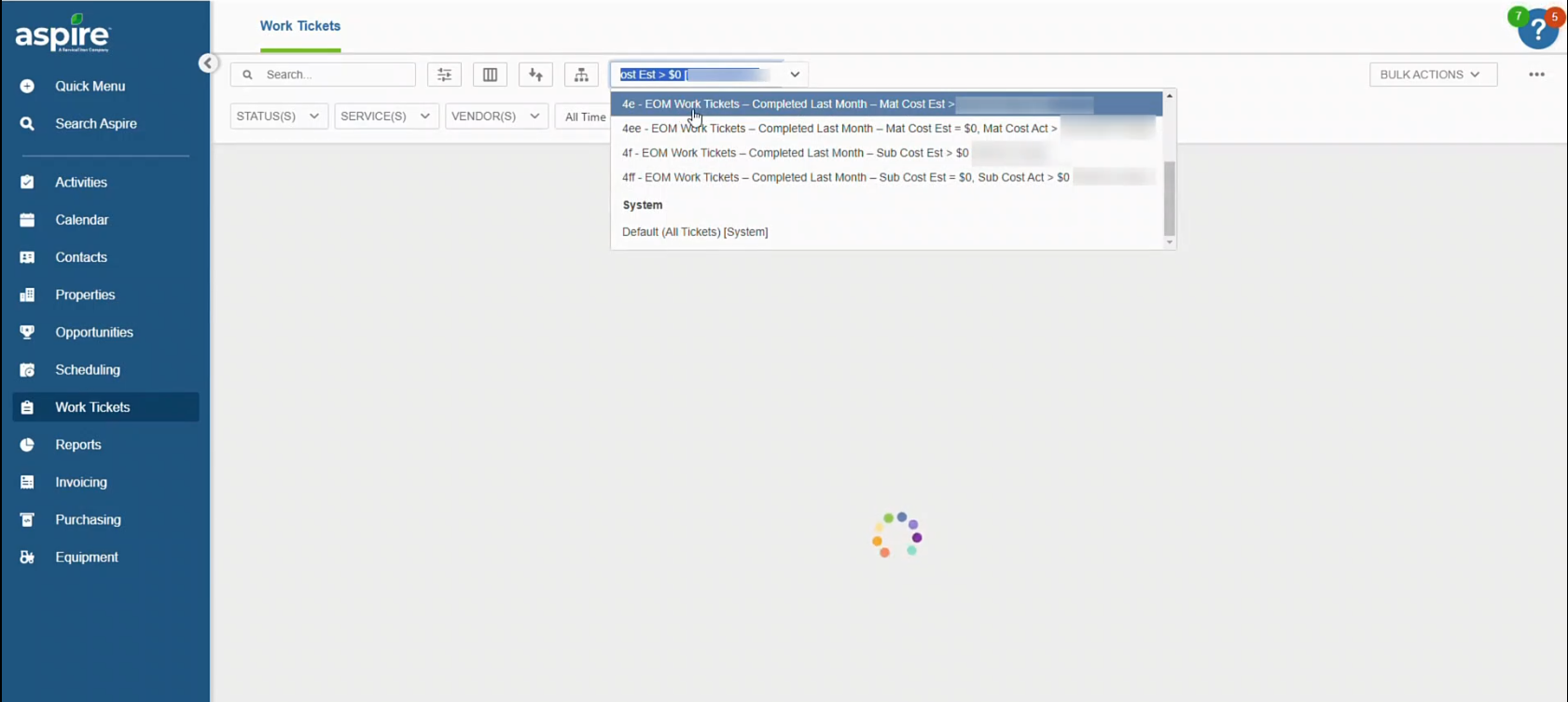

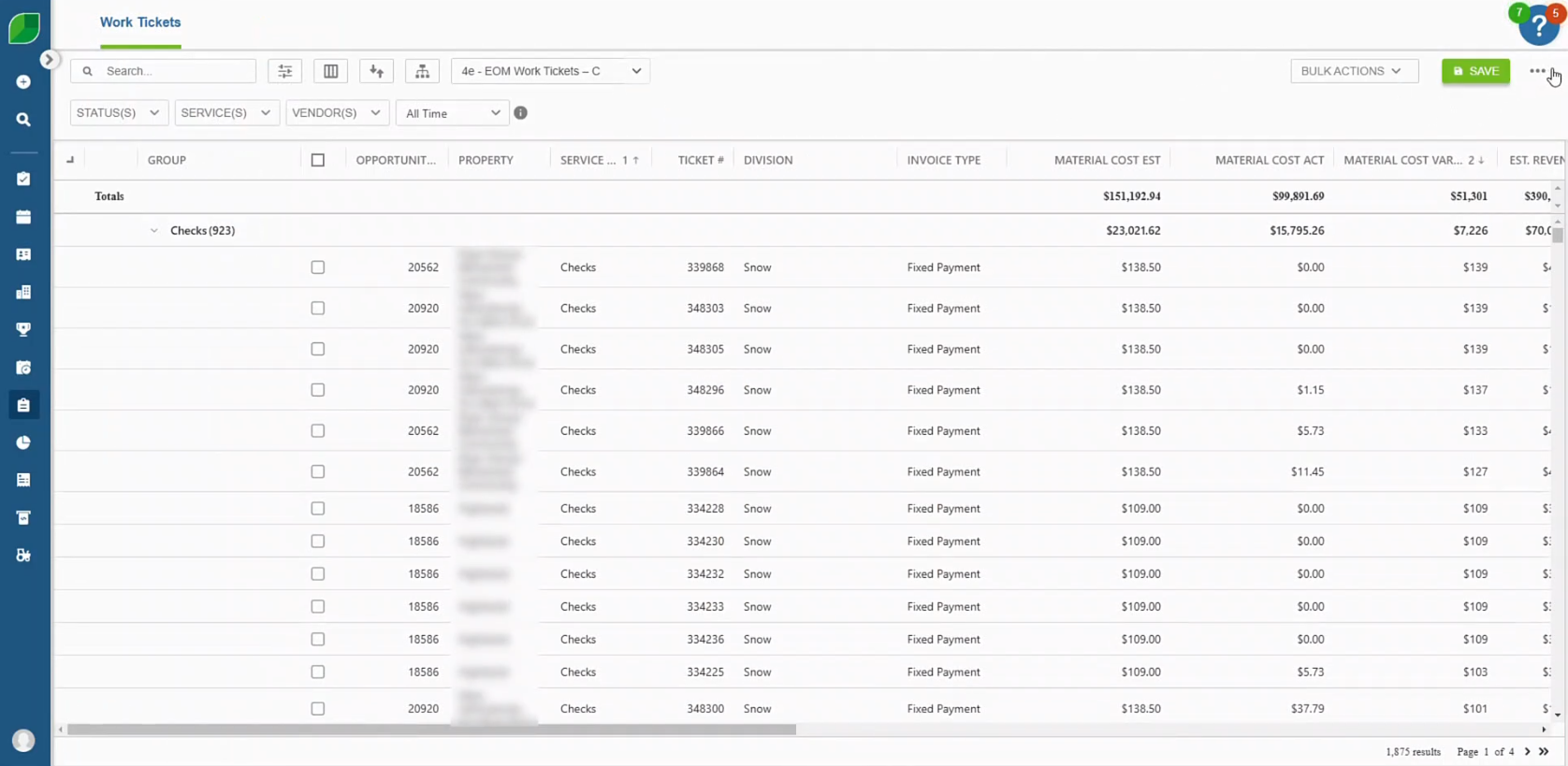

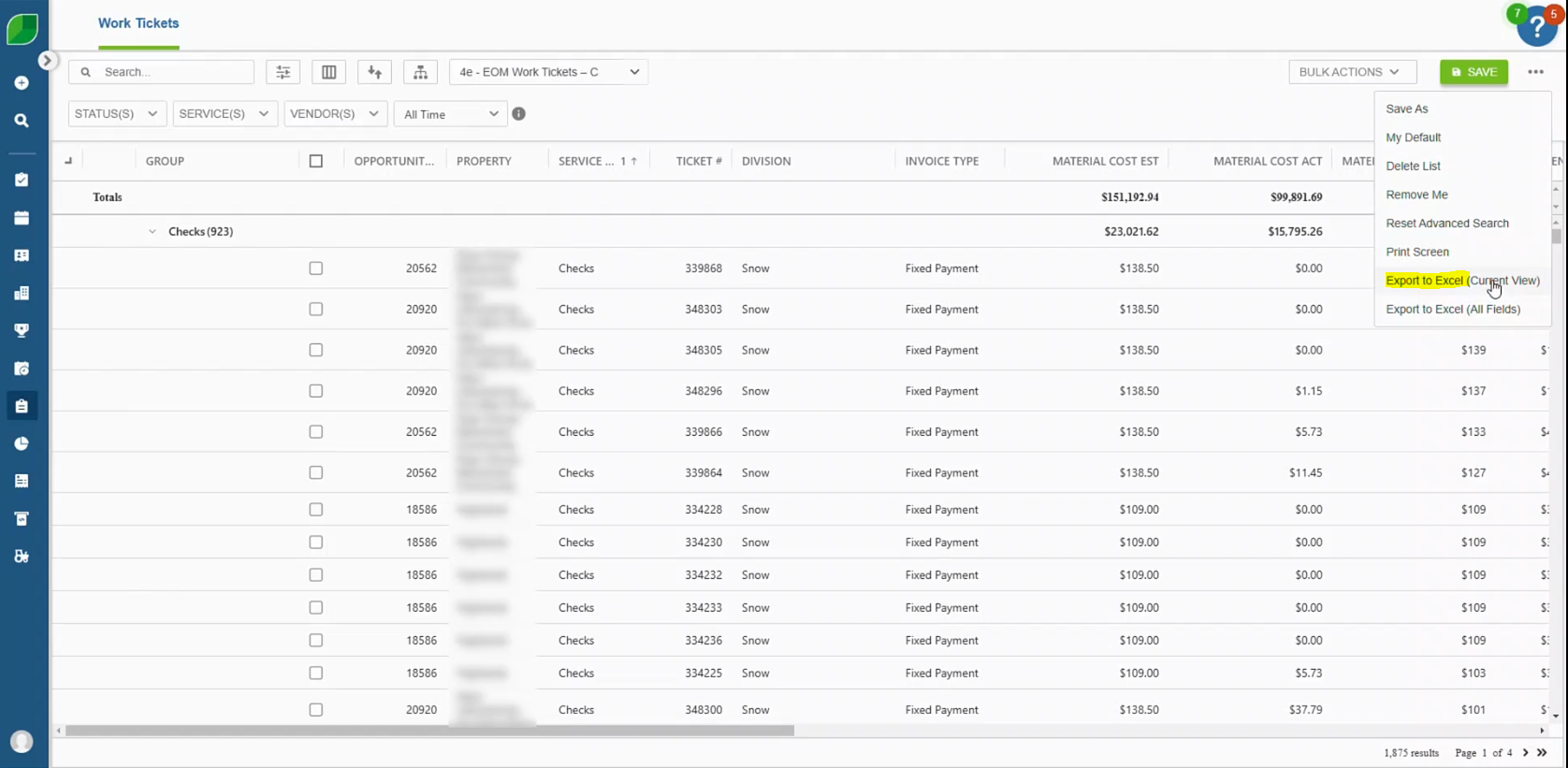

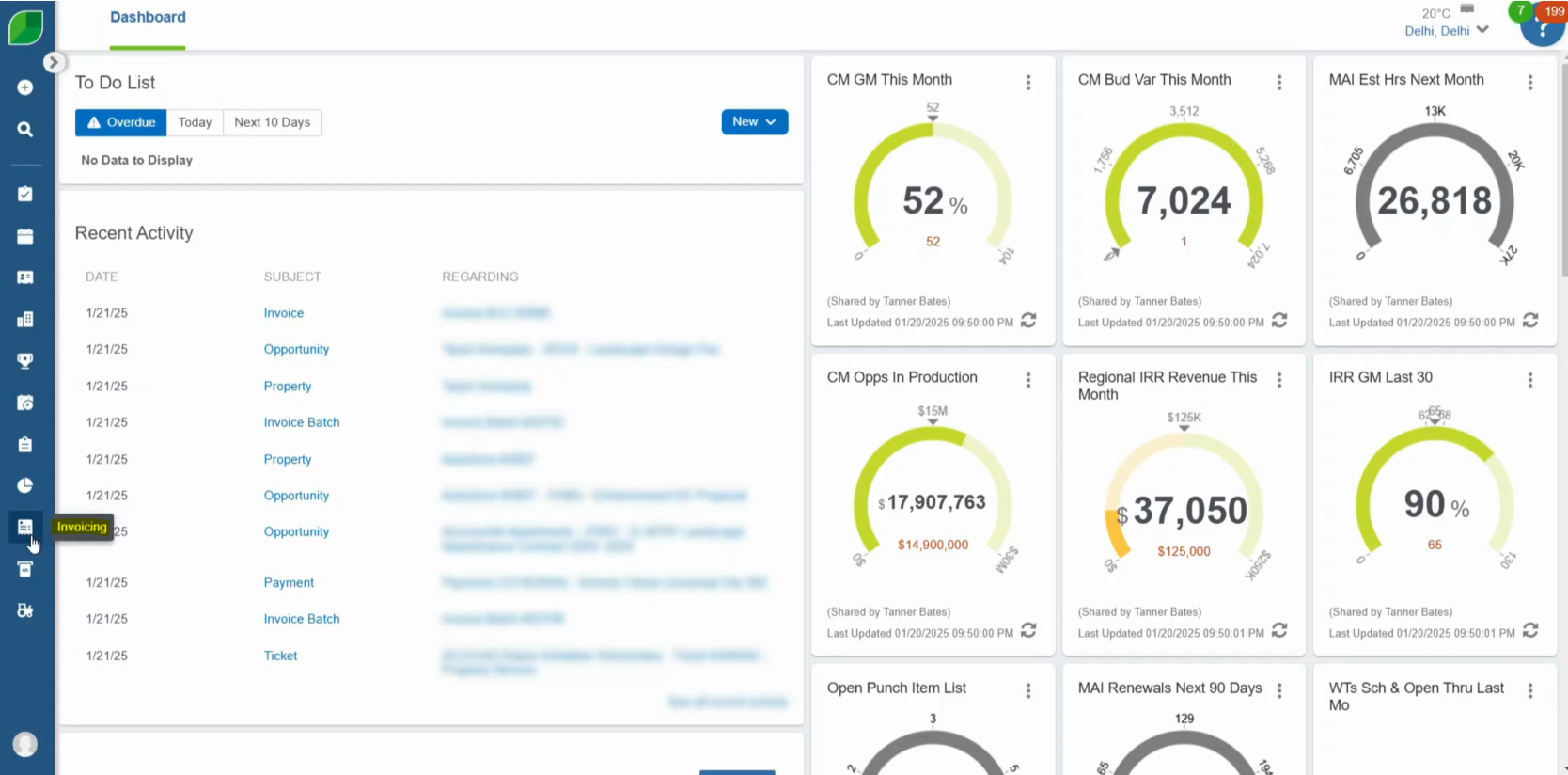

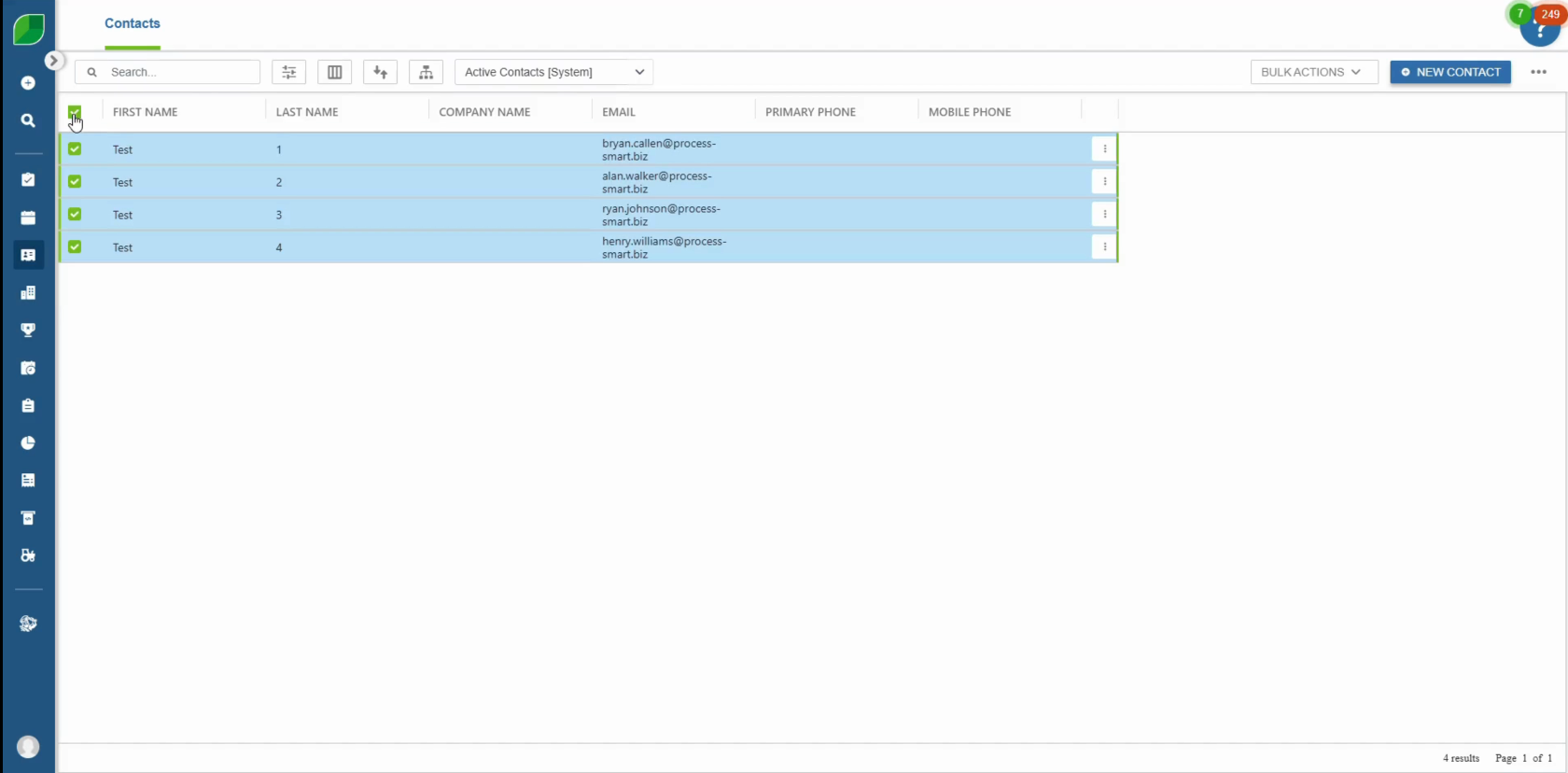

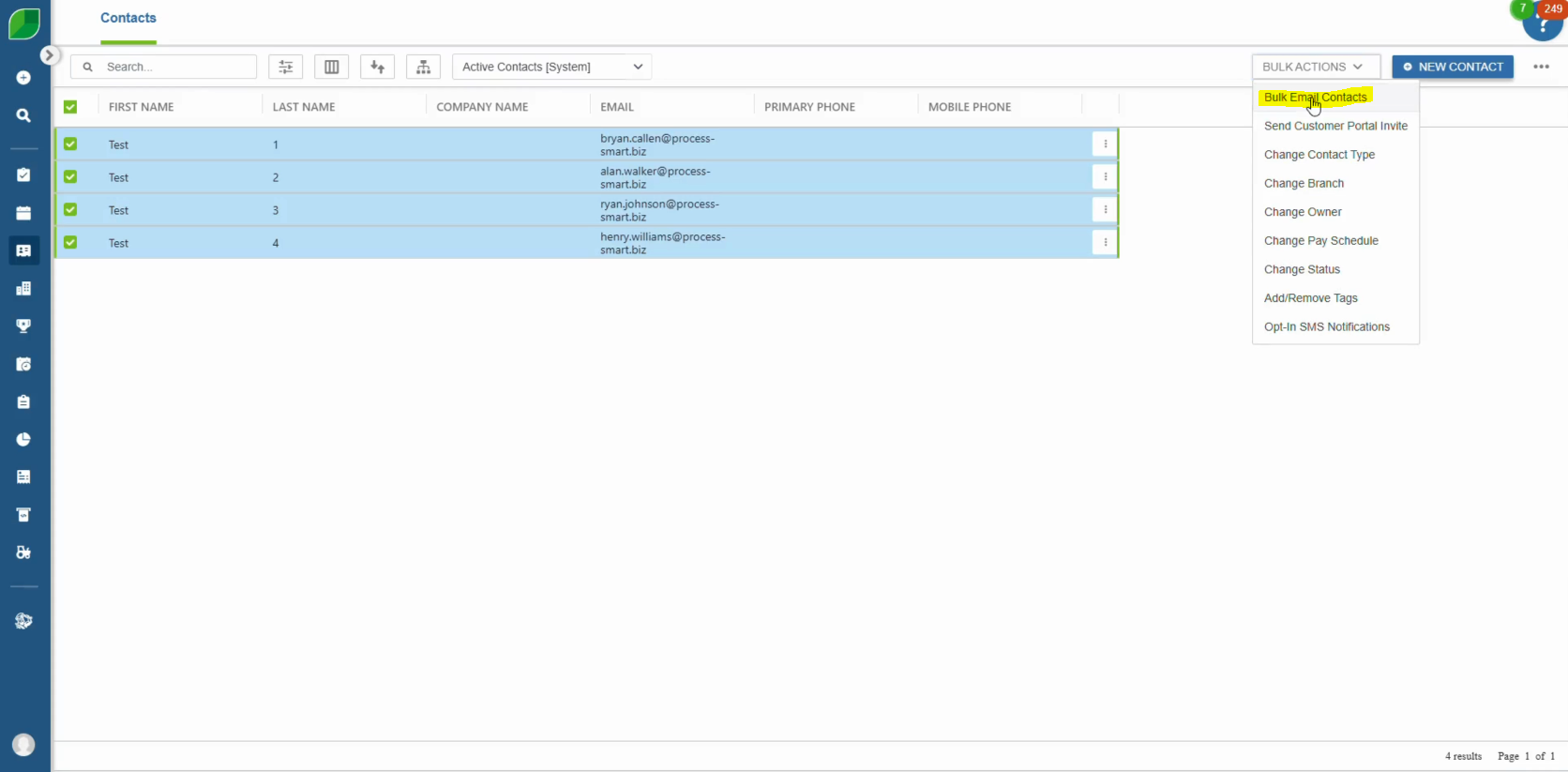

Reducing downtime and optimizing crew schedules can indirectly improve cash flow. Efficient resource allocation minimizes labor costs, allowing you to keep more cash on hand. Implementing a work ticket system, such as the one available in LMN or other CRM platforms, can streamline scheduling and resource tracking.

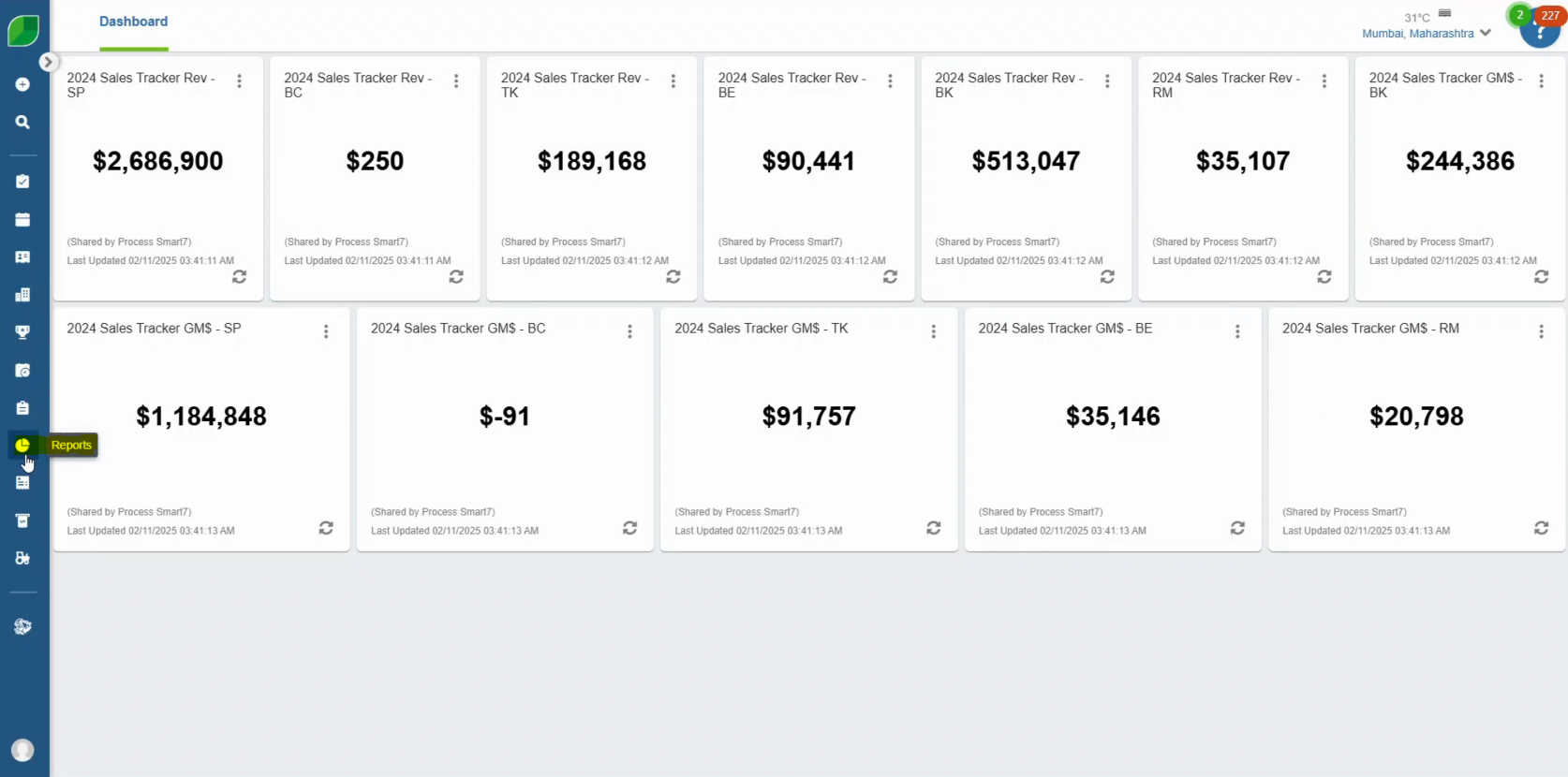

6. Diversify Revenue Streams

Expanding your service offerings can generate additional cash flow during off-peak seasons. Consider adding snow removal, holiday lighting installation, or consulting services. Diversification ensures a steadier income throughout the year.

- Reference: Green Industry Pros emphasizes the importance of recurring maintenance contracts as a reliable revenue stream.

7. Control Overhead Costs

Evaluate your operating expenses and identify areas for cost reduction. This could involve switching to more cost-effective equipment leasing options or adopting technology that increases efficiency. For example, using drone technology for site surveys can reduce labor costs while improving accuracy.

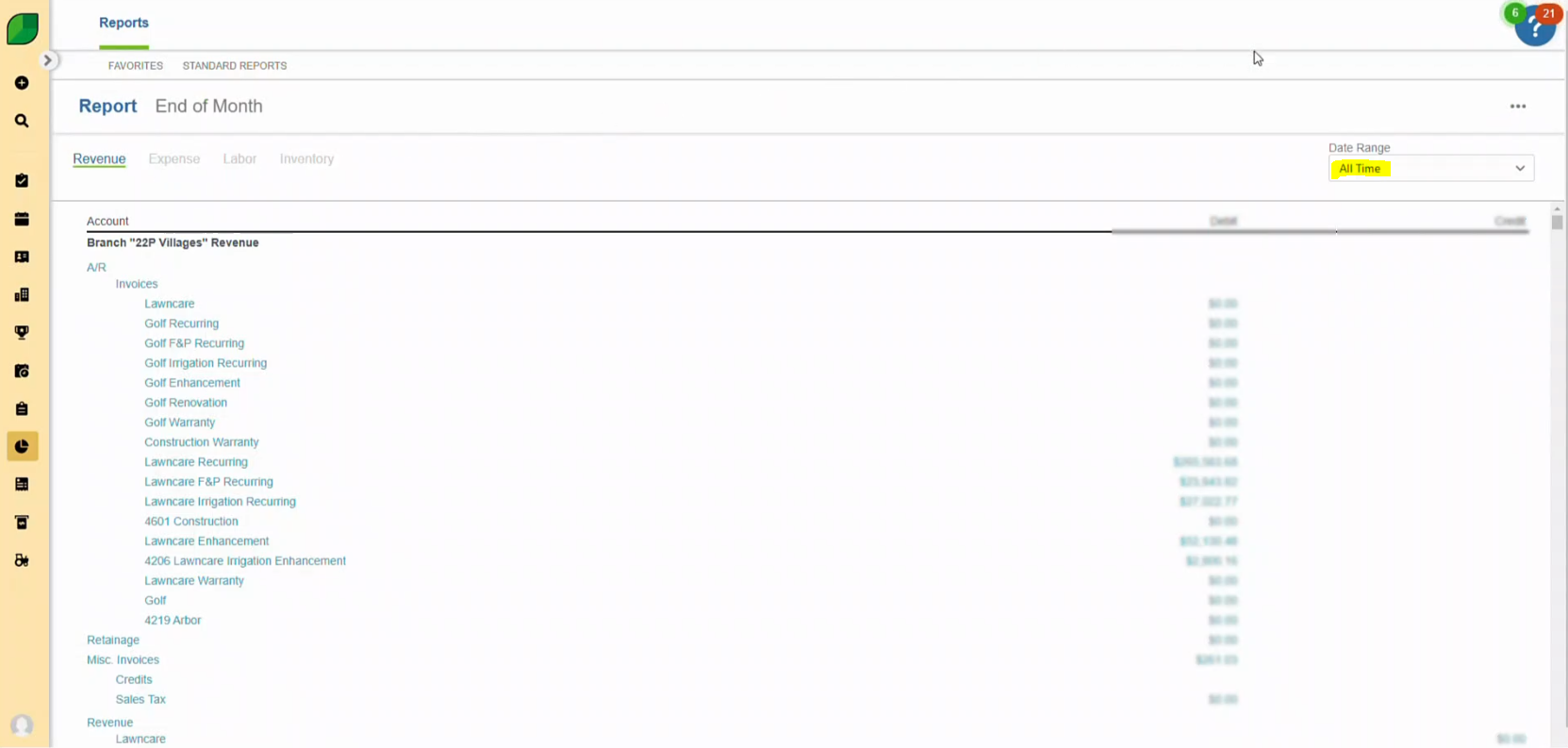

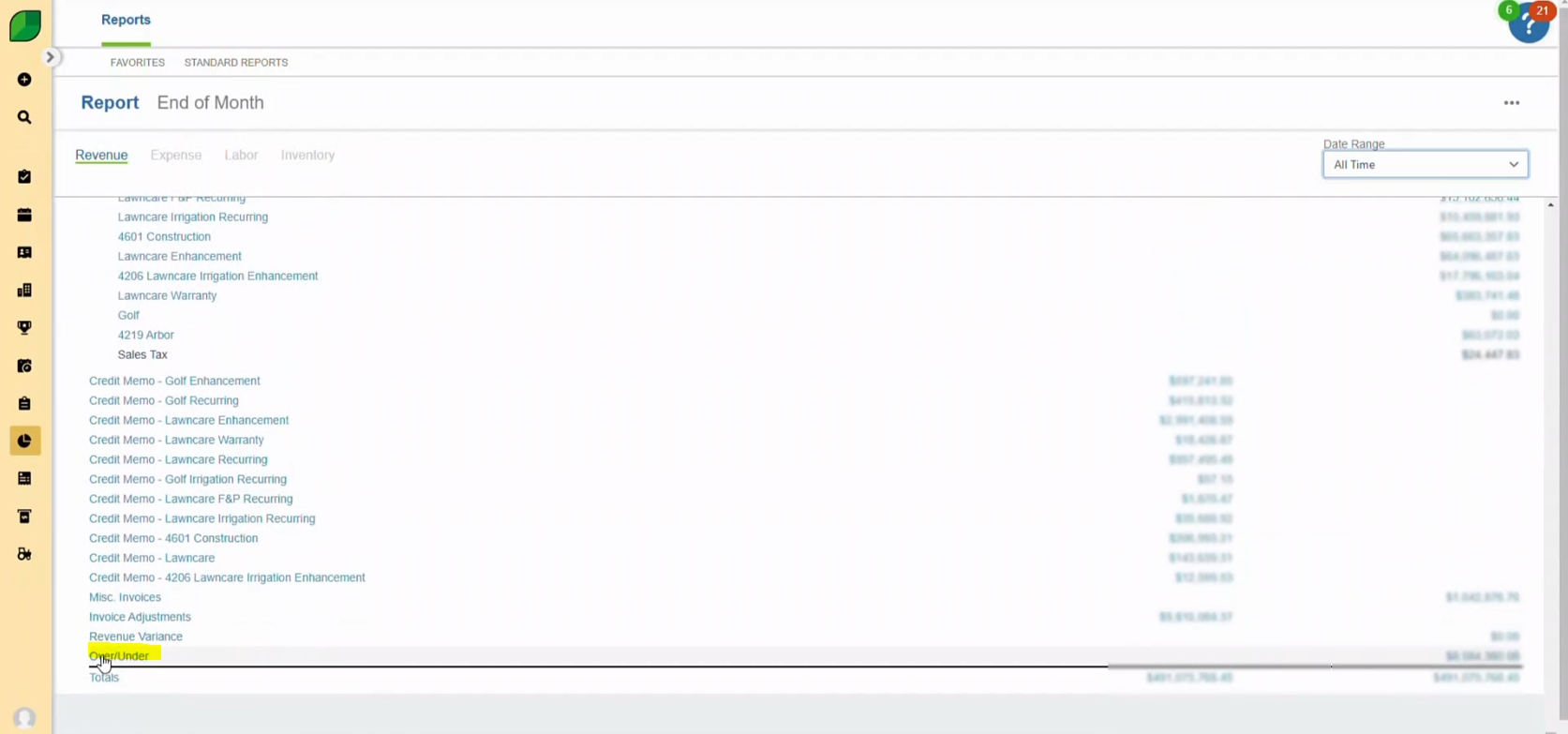

8. Develop a Cash Flow Forecast

A detailed cash flow forecast helps you anticipate and address potential shortfalls. By analyzing expected income and expenses, you can proactively secure financing or negotiate terms with clients and vendors.

- Tool Suggestion: Utilize spreadsheet templates or software like Cashflowfrog to create dynamic cash flow models.

9. Implement Late Payment Penalties

Encourage on-time payments by enforcing late payment fees. While this approach should be used judiciously, it can deter chronic delays and incentivize timely settlements.

- Best Practice: Include penalty terms in your contracts and clearly outline them on invoices.

10. Secure a Line of Credit

For unexpected expenses or delayed payments, having a line of credit can provide a financial safety net. Unlike traditional loans, lines of credit allow you to draw funds as needed, reducing interest expenses.

- Reference: NerdWallet suggests exploring small business credit options specifically tailored for seasonal businesses like landscaping.