The landscape industry thrives on the dedication, expertise, and efficiency of its workforce. However, finding, training, and retaining quality employees is a perpetual challenge for many companies. High turnover, skill gaps, and the need for consistent quality assurance often complicate operations, impacting growth and profitability. That’s where Process-Smart, a leading BPO company specializing in business process outsourcing, steps in to revolutionize your workforce strategies.

– Hiring the Right Talent

The foundation of a thriving landscape business lies in hiring employees who not only possess the necessary skills but also align with your company’s values and goals. However, recruitment can be a time-consuming process.

Challenges in Hiring:

- High demand for skilled labor in a competitive market.

- Difficulty in vetting candidates for technical and soft skills.

- Inefficient recruitment pipelines leading to delayed hiring.

How Process-Smart Can Help:

Process-Smart offers quality assurance services and streamlined recruitment support, ensuring you attract top-tier talent. With our Back Office Support Services, we manage everything from job posting and candidate screening to interview coordination. Our expertise in AI and Artificial Intelligence tools further enhances the process by leveraging data-driven insights for better hiring decisions.

– Training for Excellence

Hiring the right talent is only the first step. Proper training ensures that employees can meet industry standards and customer expectations, especially in the landscape sector, where precision and efficiency are key.

Challenges in Training:

- Lack of structured training programs.

- Inconsistent skill levels among new hires.

- Time constraints for managers tasked with training responsibilities.

How Process-Smart Can Help:

With Business Process Outsourcing, Process-Smart designs and manages training programs tailored to the landscape industry. Our quality control services ensure consistent skill development, while our Auditing Services monitor progress and identify improvement areas. For businesses with large training needs, we offer scalable solutions to ensure every team member is well-prepared.

– Retaining Top Talent

Retention is one of the most pressing issues in the landscape industry, where high turnover can disrupt operations and inflate costs. Employees leave for various reasons, including lack of growth opportunities, inadequate compensation, and poor work-life balance.

Challenges in Retention:

- High industry turnover rates.

- Limited career advancement paths.

- Lack of employee engagement initiatives.

How Process-Smart Can Help:

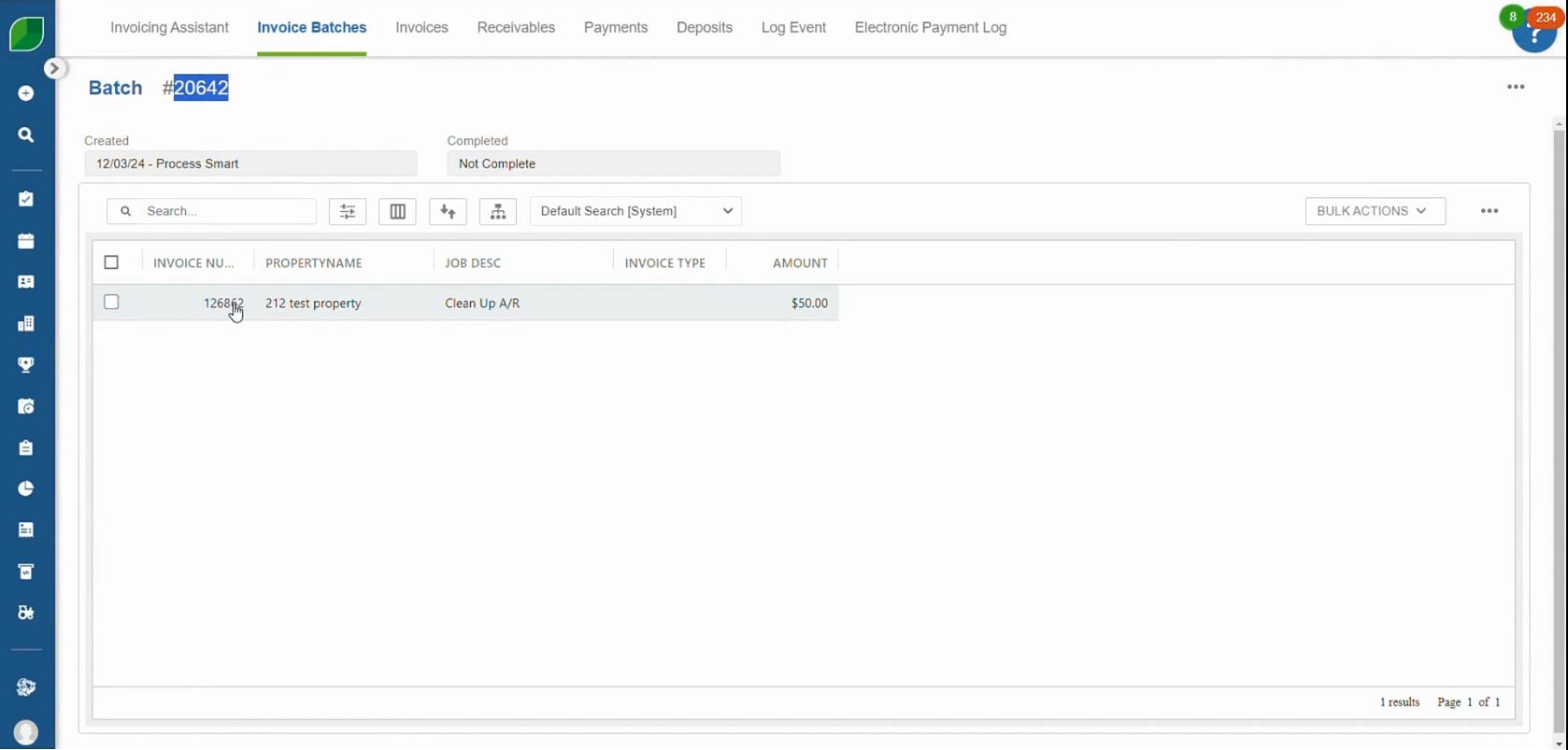

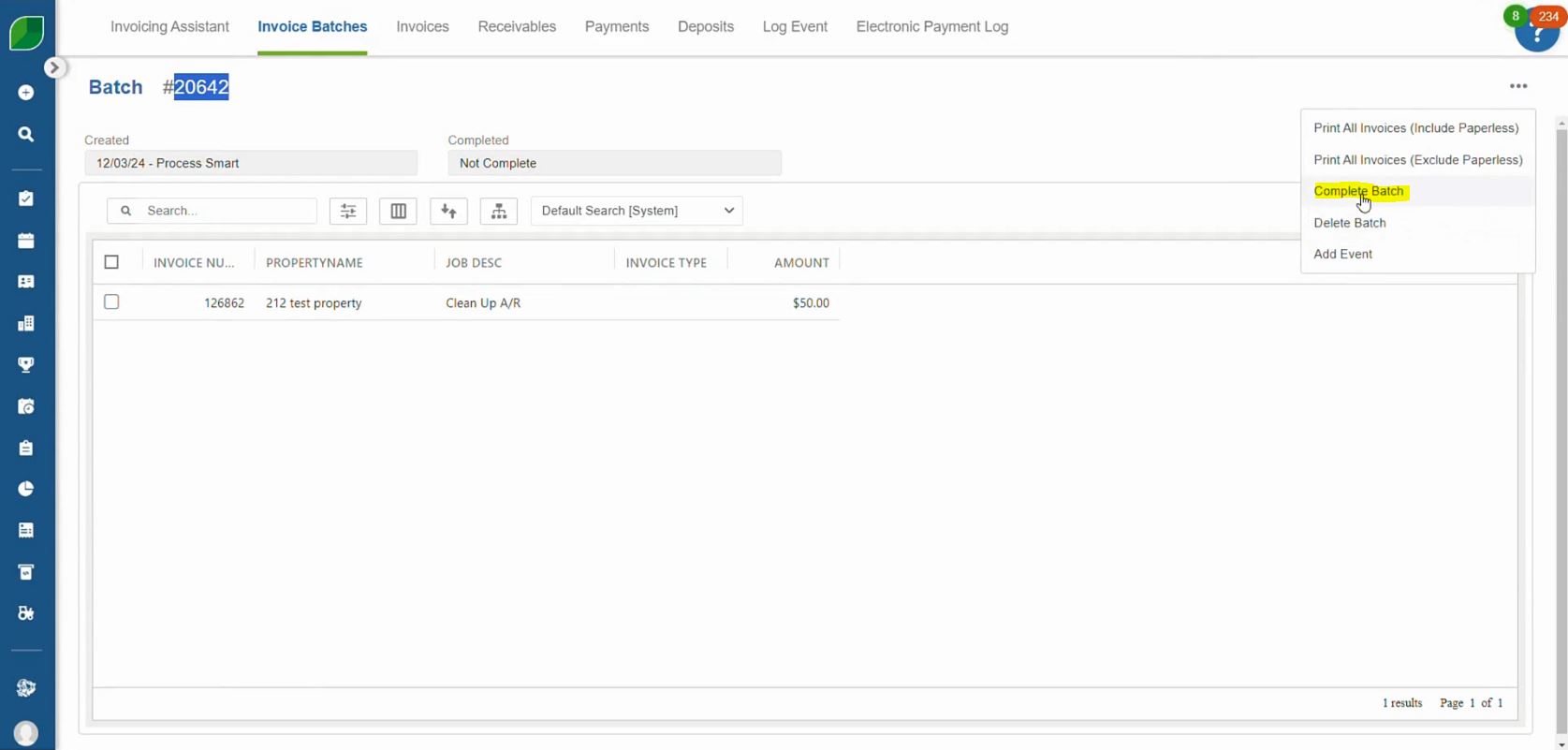

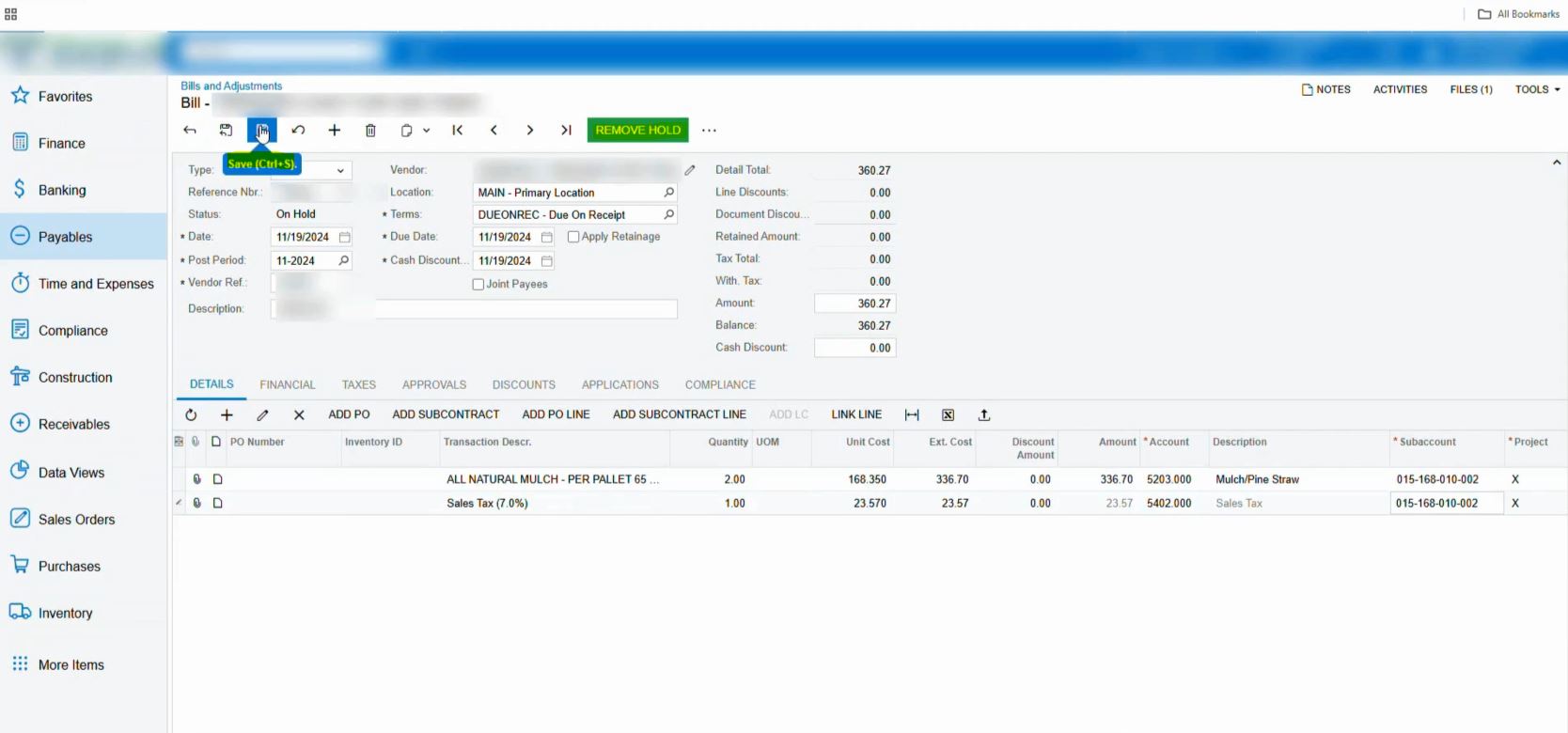

Process-Smart supports retention by offloading repetitive administrative tasks through our Back Office Support and Accounts Payable services, freeing your managers to focus on employee development. Our payroll tax management solutions ensure timely and accurate compensation, enhancing job satisfaction. Additionally, we can help implement feedback mechanisms and employee engagement tools, creating a supportive workplace environment.

Streamlining Operations with Process-Smart

Beyond hiring, training, and retention, Process-Smart empowers landscape companies to focus on growth and customer satisfaction by handling essential back-office and operational functions. Our comprehensive services include:

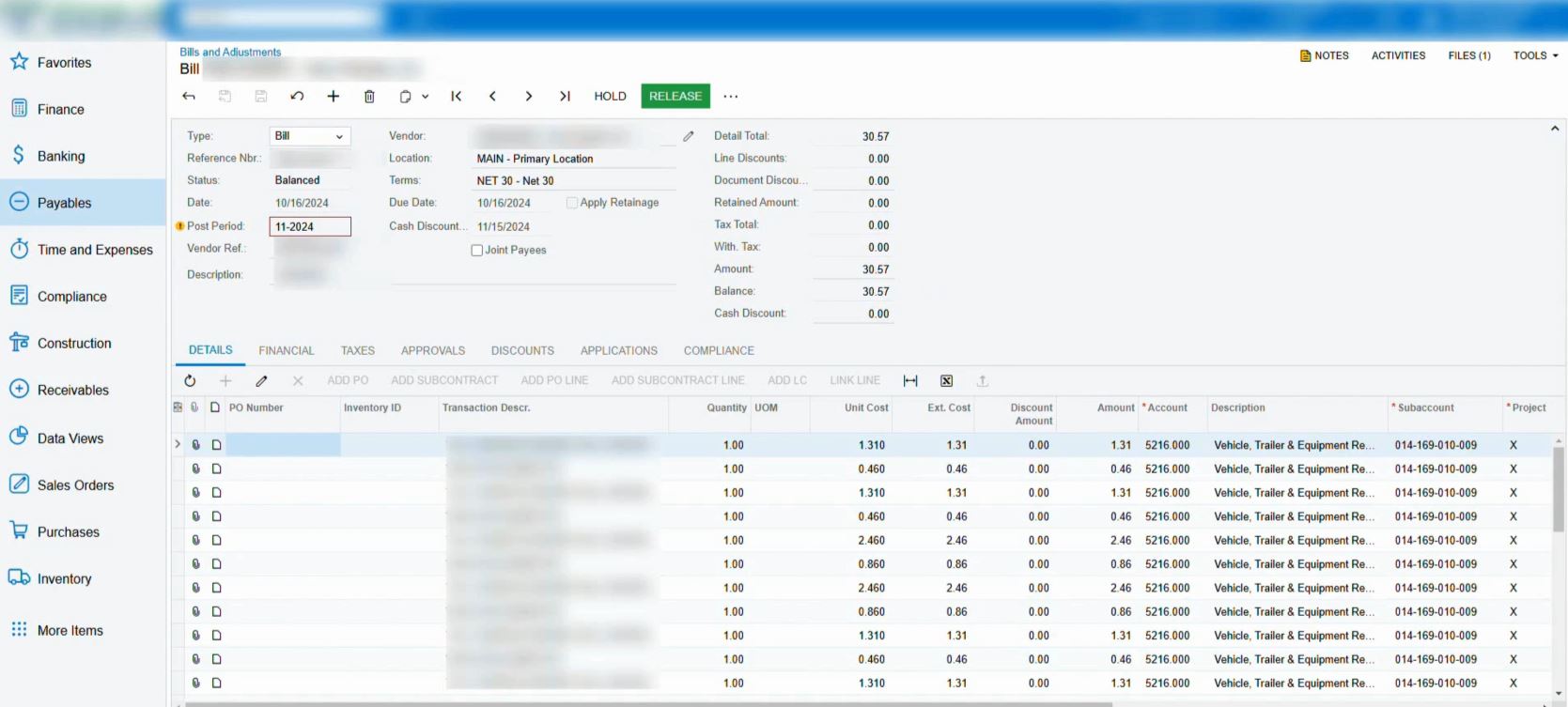

- Outsourced Bookkeeping Services: Maintain accurate financial records with our expert bookkeeping team.

- Payroll Tax Management: Ensure compliance and timeliness in employee payroll.

- Customer Chat Support and Call Center Support: Deliver excellent customer service to retain clients.

- Digital Marketing Services Near Me: Boost your visibility and attract new customers with targeted digital campaigns.

By outsourcing these functions to Process-Smart, you can reduce costs, enhance efficiency, and focus on your core business operations.

Quality Control and Assurance

Maintaining high standards is critical in landscaping, where customer satisfaction often hinges on the smallest details. Our quality assurance services and Auditing Services help ensure that your projects meet industry benchmarks. We also utilize AI tools to monitor and improve processes continuously.

Why Choose Process-Smart?

Process-Smart is more than a BPO company—we’re your strategic partner in building a resilient and efficient workforce. Our ability to tailor solutions for the landscape industry, combined with our expertise in Business Process Offshoring and quality control services, makes us the ideal choice for landscape companies looking to streamline their operations.

Contact Us

Ready to transform your hiring, training, and retention strategies? Discover how Process-Smart can elevate your landscape business. Whether you’re searching for companies near me or exploring the benefits of business process outsourcing, we’re here to help.

Let Process-Smart take the reins of your back office support, allowing you to focus on delivering exceptional landscaping services. Contact us today for a consultation and start your journey toward operational excellence.