In 2025, businesses are expected to begin to move away from old-fashioned accounting methods and migrate towards Flexible FAaaS—Finance & Accounting as a Service—instead of in-house teams or fixed contracts. This shift will happen because FAaaS offers faster service, lower cost, and better control. In this article, we explain what Flexible FAaaS means, why it works, and how it will reshape accounting in 2025.

What Is Flexible FAaaS?

Flexible FAaaS stands for Finance & Accounting as a Service. It means that a company outsources its finance and accounting work to a third-party provider. The provider handles tasks such as bookkeeping, payroll, invoicing, tax filings, and financial reporting. Unlike traditional models, Flexible FAaaS adapts to the company’s needs. Companies pay for the services they use, when they use them. Services and resources can be scaled up or down each month as needed, and long-term contracts and fixed fees are avoided. Companies receive expert support without hiring full‐time staff.

Flexible FAaaS uses cloud technology and secure data connections to provide real-time access to financial data. Team members can log into dashboards, review reports, and approve transactions from anywhere. The service provider uses automation to handle routine tasks. A human team steps in to review exceptions, answer questions, and provide guidance. This mix of machines and people delivers accuracy, speed, and a personal touch to accounting practices.

Why Traditional Accounting Models Fall Short

Traditional accounting relies on in-house teams or rigid outsourcing contracts. Under this model, a company hires employees or is required to sign multi-year agreements. A company must pay fixed salaries, benefits, or monthly fees, decreasing flexibility and increasing overhead costs. In-house teams need hardware, software, and office space. Business leaders must manage hiring, training, and turnover.

Rigid outsourcing contracts lock companies into a set scope. If your business grows, you face new fees or renegotiations. If your business slows down, you still pay full price. Under this model it becomes quite easy to lose control over costs and timelines, and delays are inevitable while you work to scale up or down. Paper invoices, manual approvals, and batch reporting slow down month-end closing and planning.

Traditional models also limit access to expertise. Small businesses may not have the budget to hire a senior accountant to manage these processes in-house. They may not have a tax specialist on call. In a fast-changing world, businesses need up-to-date knowledge of new rules, tools, and best practices. Old models make it hard to adapt.

The Rise of Flexible FAaaS in 2025

In 2025, business leaders will look for solutions that match their fast-moving needs. They will want a service that can flex with their growth, scale back when needed, and add new functions on demand. Flexible FAaaS meets these needs.

First, cloud adoption reached near-universal levels in 2024. Companies already use cloud tools for sales, marketing, and operations. Extending the cloud to finance and accounting just makes sense. It removes on-premise servers, manual file transfers, and paper, providing real-time data and secure access.

Second, automation and AI tools have matured. By 2025, these tools handle invoice processing, bank reconciliations, and expense categorization with high accuracy. Human teams focus on analysis, strategy, and problem solving. This blend speeds up close cycles, cuts errors, and lowers cost.

Third, the workforce changed during the pandemic. Remote and hybrid work became normal. Companies learned to manage teams across time zones. They embraced digital collaboration and asynchronous approvals. This shift proved that a remote FAaaS model can deliver high quality and strong service levels.

Key Advantages of Flexible FAaaS

1. Cost Control and Predictability

With Flexible FAaaS, companies know what they will pay. FaaaS provides the ability to choose only the services needed, allowing businesses to avoid fixed monthly staff costs, including benefits and office overhead. Companies can save on software licenses and hardware, as well as reduce variable costs by scaling down when work slows. They gain budget certainty with clear, itemized service fees.

2. Speed and Agility

Flexible FAaaS providers use automated workflows. They clear invoices and reconcile accounts in real time. They close books faster, often within days of month-end. They generate financial statements and key metrics on demand. This speed lets companies spot trends, adjust plans, and seize opportunities faster than ever before.

3. Access to Expertise

A Flexible FAaaS team brings together junior staff, senior accountants, tax experts, and financial analysts. Businesses tap into this full spectrum of talent without hiring each person full time. This comes with get guidance on new accounting standards, tax regulation changes, and industry best practices, allowing companies to benefit from years of combined experience across many clients.

4. Enhanced Compliance and Security

Reputable FAaaS providers follow strict data security and compliance standards. They use encryption, multi-factor authentication, and regular audits. They maintain SOC 2 or ISO 27001 certifications. Companies gain peace of mind that their financial data is safe and compliant with rules like SOX or GDPR. These standards also reduce the risk of human error in manual processes.

5. Seamless Technology Integration

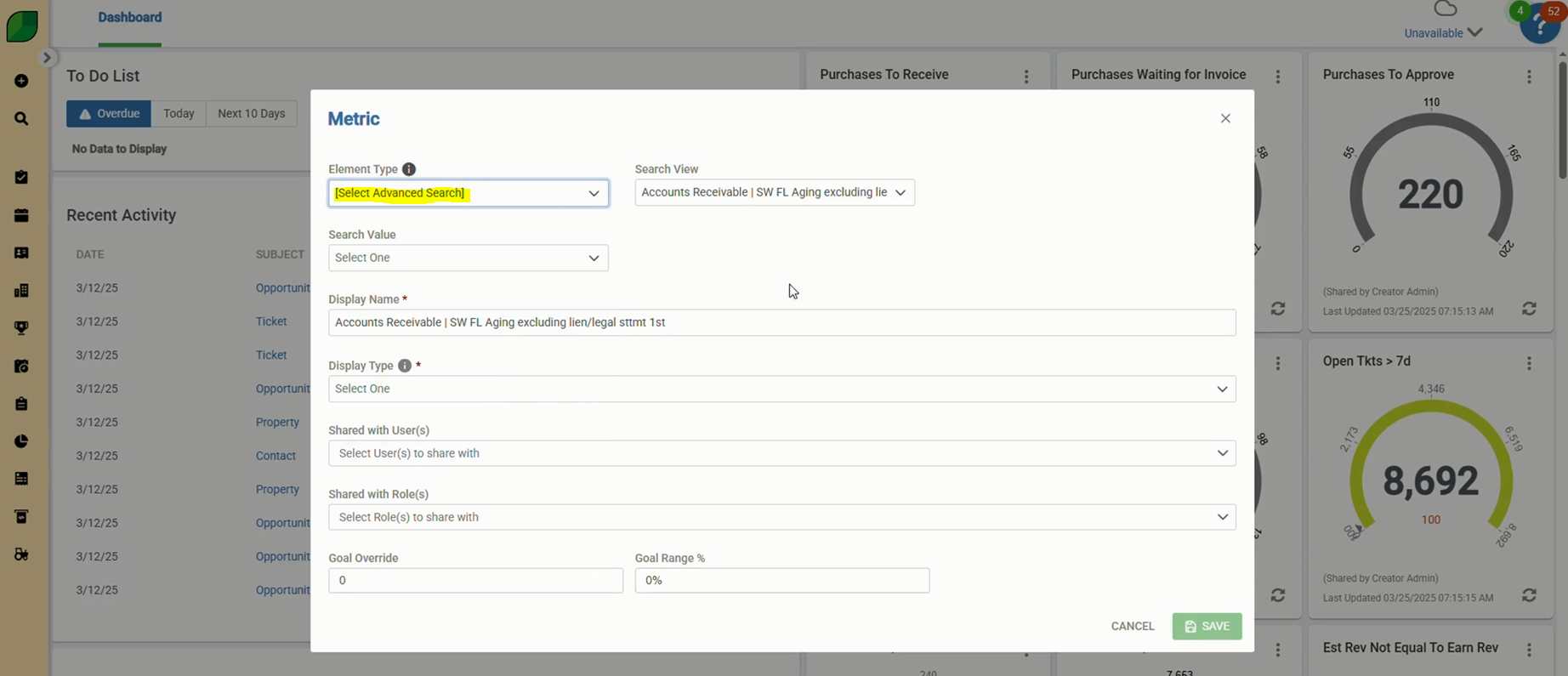

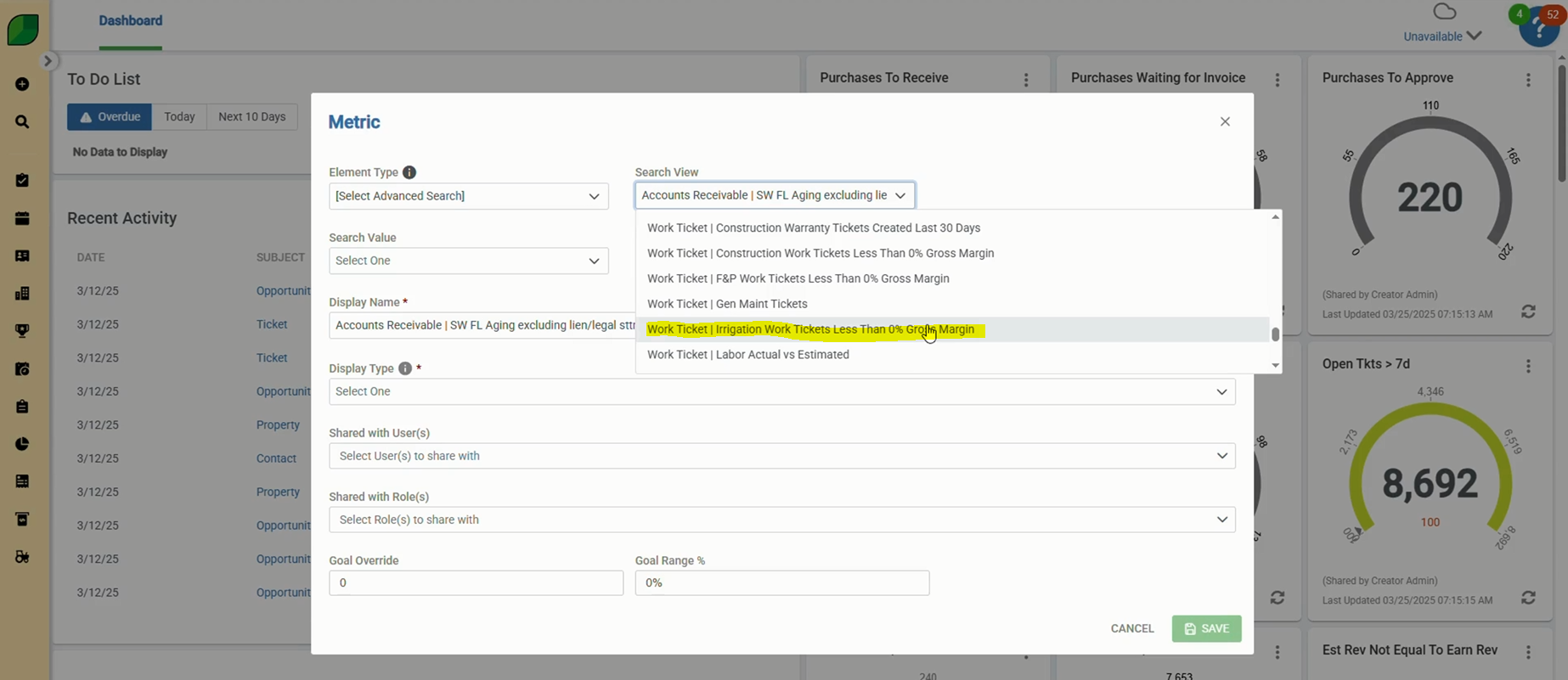

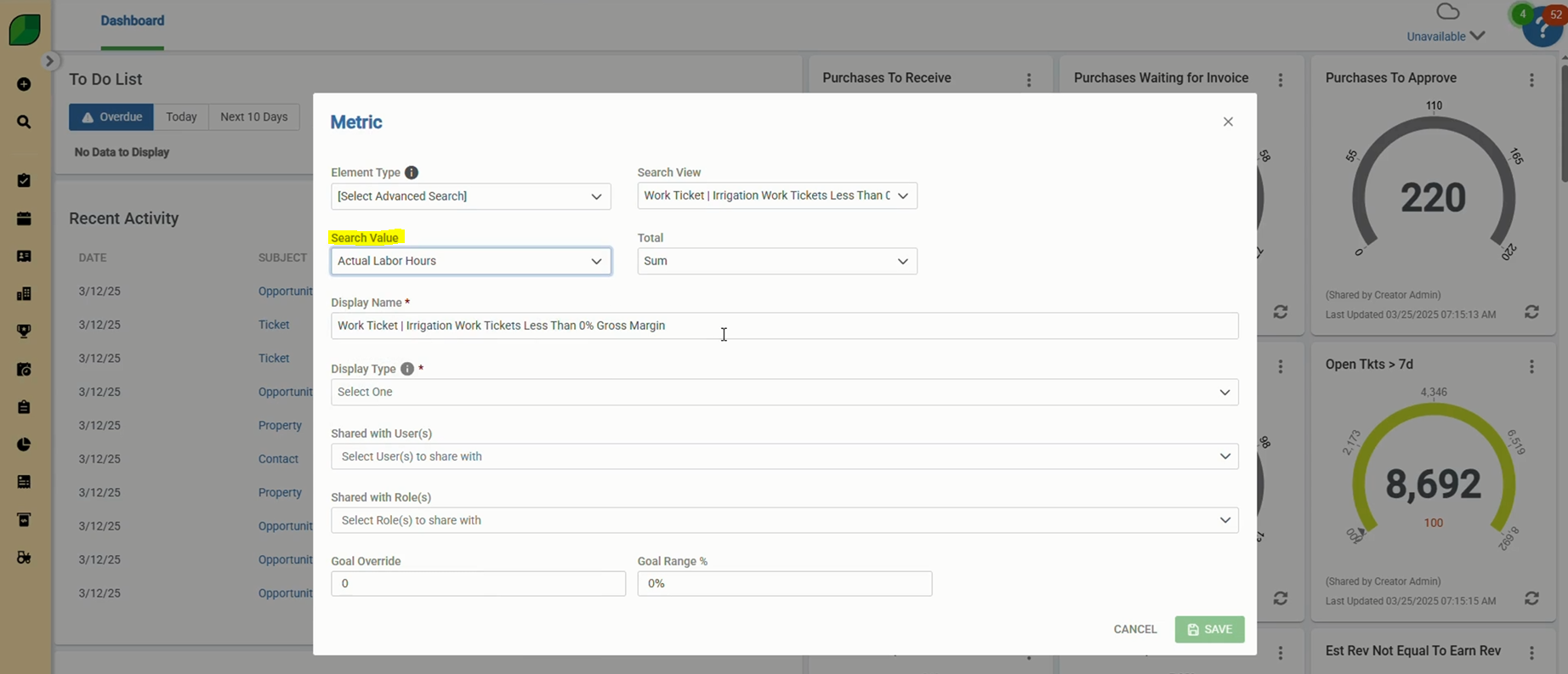

Flexible FAaaS teams connect to existing ERP, CRM, or billing systems. They work within your technology stack without disrupting it. They set up automated data feeds between your bank and accounting software. They use dashboards that integrate multiple sources of truth. Companies avoid duplicate data entry and enjoy a unified view of operations and finance.

How Flexible FAaaS Enhances Decision-Making

Real-time financial data drives better decisions. With traditional models, companies wait weeks for month-end reports, then create business plans based on stale data. With Flexible FAaaS, they get daily or weekly reports on cash flow, burn rate, and profitability, leading to the ability to forecast more accurately and adjust course quickly.

Your team can run scenario analyses—such as the impact of price changes, new hires, or marketing campaigns—on demand. The FAaaS team handles the heavy lifting of data gathering and model building while company leaders focus on strategy and implementation, not spreadsheets.

Overcoming Common Concerns

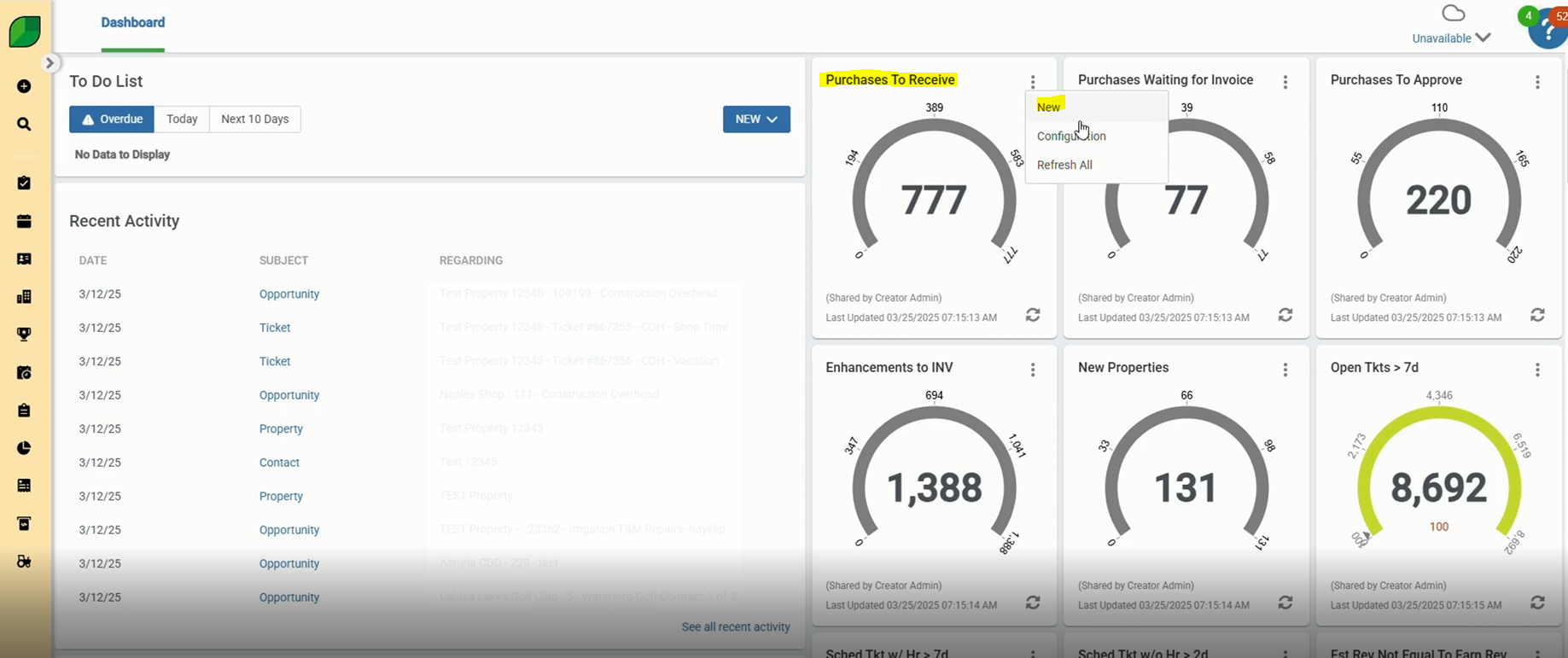

Some leaders worry that outsourcing finance and accounting means losing control. Flexible FAaaS addresses this by providing direct access and transparency. Decision makers get a dashboard with real-time status updates on every task. They have visibility to open invoices, pending approvals, and upcoming deadlines and can drill into details or request custom reports.

Others fears may be hidden costs. A good FAaaS partner offers clear service catalogs and tiered pricing. You know exactly what each service costs and can add or remove modules as the needs of your business change, avoiding surprise fees at year-end.

A third concern is data security. Top FAaaS providers adopt bank-grade security measures. They segment customer data, encrypt in transit and at rest, and conduct regular penetration tests. They also sign strict NDAs and comply with relevant regulations.

Preparing for the Shift in 2025

To move smoothly to Flexible FAaaS, companies should take several steps now:

- Audit Current Processes

Map existing accounting workflows. Identify manual steps, bottlenecks, and points of high error. Evaluate which tasks can be automated or outsourced.

- Assess Technology Landscape

Inventory current systems—ERP, payroll, invoicing, expense management, and reporting tools. Check for API capabilities and integration options.

- Define Service Needs

Decide which accounting functions can be outsourced. Common starting points include accounts payable, bank reconciliation, and expense processing. Plan to add payroll, tax filings, or financial analysis later.

- Set Goals and Metrics

Determine success criteria: cost savings percentage, close-cycle time, error reduction rate, or team satisfaction. Use these benchmarks to evaluate FAaaS providers.

- Choose the Right Partner

Look for a FAaaS provider with strong U.S. references, clear pricing, and a track record in your industry. Ask about their security certifications, team structure, and onboarding process.

- Plan the Transition

Work with your provider to develop a phased rollout plan. Start with non-critical processes to build trust and refine workflows, then expand to core functions once you are comfortable.

- Train Your Team

Ensure your internal staff knows how to interact with the FAaaS team and dashboard. Clarify roles for approvals, escalations, and exceptions, fostering a culture of collaboration.

Case Study: A Small Tech Startup’s Success

Consider a small tech startup that struggled with manual accounting. It used three full-time accountants and spent 10 days closing the books each month. By shifting to Flexible FAaaS in early 2024, the startup reduced monthly close time to two days. It cut accounting costs by 40% and gained direct access to a senior tax specialist. The startup now spends more time on strategy and less on data entry. It also receives weekly financial insights that guide product pricing and hiring decisions.

The Future of Accounting in 2025

By 2025, Flexible FAaaS is expected to increase in popularity with businesses of all sizes. Advances in AI and machine learning will further automate routine tasks. Providers will offer on-demand services—such as 24/7 cash-flow alerts and instant audit readiness checks. Businesses will see the benefits of treating finance not as a back-office function, but as a strategic partner. They will focus on growth, innovation, and customer value, while FAaaS teams handle the numbers.

Why Process-Smart Makes the Perfect FAaaS Partner

Process-Smart pioneered the flexible FAaaS model for small and mid-sized businesses. We blend cutting-edge automation with a human-in-the-loop approach. Our services include:

- Accounts Payable & Receivable

- Bank Reconciliation & Close Support

- Payroll & Tax Filings

- Financial Reporting & Analysis

- ERP & CRM Integration

We secure your data with SOC 2 compliance and daily backups. We assign a dedicated team that knows your business. Business leaders log into our portal to see real-time updates, approve transactions, and download reports. Businesses only pay for the services they use—no surprises.

Ready to move your accounting to the cloud?

Contact Process-Smart today to learn how our Flexible FAaaS can save time, cut costs, and provide the financial insights your company needs to thrive in 2025 and beyond.